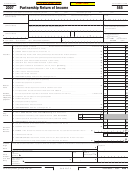

R Was there a distribution of property or transfer (for example by sale or death) of a partnership interest during the taxable year? .

Yes

No

If “Yes,” see the federal instructions concerning an election to adjust the basis of the partnership’s assets under IRC Section 754

Yes

No

S Is this partnership a publicly traded partnership as defined in IRC Section 469(k)(2)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

T Is this partnership under audit by the IRS or has it been audited in a prior year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

U (1)

Does the partnership have any foreign (non U .S .) nonresident partners? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

(2)

Does the partnership have any domestic (non-foreign) nonresident partners? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

(3)

Were Form 592, Form 592-A, Form 592-B, and Form 592-F filed for these partners? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

V Is this an investment partnership? See General Information O, Investment Partnerships, in the instructions . . . . . . . . . . . . . . . . .

Yes

No

W Is the partnership apportioning or allocating income to California using Schedule R? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

X Has the partnership included a Reportable Transaction or Listed Transaction within this return? . . . . . . . . . . . . . . . . . . . . . . . . . .

(See instructions for definitions .) If “Yes,” complete and attach federal Form 8886 for each transaction .

Yes

No

Y Did this partnership file the Federal Schedule M-3 (Form 1065)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Z Is this partnership a direct owner of an entity that filed a federal Schedule M-3? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Yes

No

AA Does this partnership have a beneficial interest in a trust or is it a grantor of a trust? Attach name, address, and FEIN . . . . . . . . . .

BB Does this partnership own an interest in a business entity disregarded for tax purposes? If “Yes,” complete Schedule EO, Part II .

Yes

No

Yes

No

CC (1)

Is the partnership deferring any income from the disposition of assets? (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

(2)

If “Yes,” enter the year of asset disposition . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

DD Is the partnership reporting previously deferred income from:

Installment Sale

IRC §1031

IRC §1033

Other

EE “Doing business as” name . See instructions:

____________________________________________________________________

FF (1)

Has this partnership operated as another entity type such as a corporation, S corporation, General Partnership,

Yes

No

Limited Partnership, LLC or Sole Proprietorship in the previous five (5) years? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(2)

If “Yes”, provide prior FEIN(s) if different, business name(s), and entity type(s) for prior returns filed with

the FTB and/or IRS . (see instructions): _______________________________________________________________________________________

Yes

No

GG (1)

Has this partnership previously operated outside California? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

(2)

Is this the first year of doing business in California? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to ftb.ca.gov and search for privacy

notice . To request this notice by mail, call 800 .852 .5711 .

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct,

and complete . Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge .

Sign

Date

Signature of

Here

Telephone

general partner

(

)

General Partner’s email address (optional)

Paid

Date

PTIN

Paid

Check if

Preparer’s

Prepar-

self-employed

signature

er’s Use

Telephone

FEIN

Firm’s name (or yours if self-employed) and address

-

Only

(

)

May the FTB discuss this return with the preparer shown above (see instructions)?. . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Form 565

2016 Side 3

3663163

C1

1

1 2

2 3

3 4

4 5

5