Instructions For Completing Form Ncui 685

ADVERTISEMENT

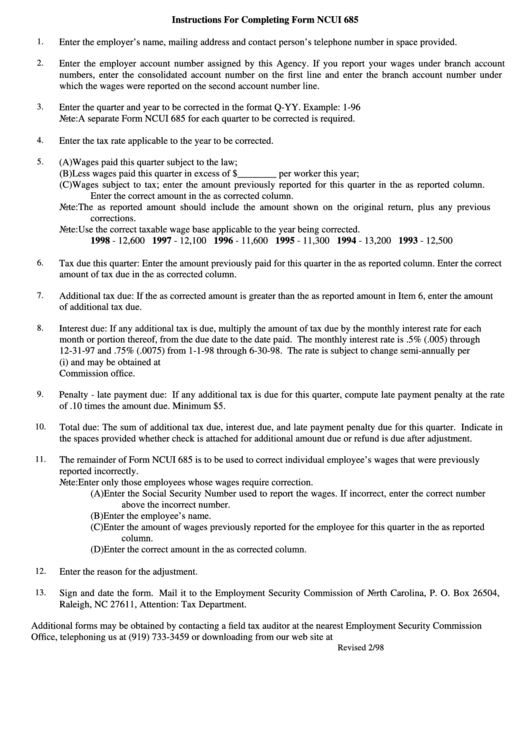

Instructions For Completing Form NCUI 685

1.

Enter the employer’s name, mailing address and contact person’s telephone number in space provided.

2.

Enter the employer account number assigned by this Agency. If you report your wages under branch account

numbers, enter the consolidated account number on the first line and enter the branch account number under

which the wages were reported on the second account number line.

3.

Enter the quarter and year to be corrected in the format Q-YY. Example: 1-96

Note: A separate Form NCUI 685 for each quarter to be corrected is required.

4.

Enter the tax rate applicable to the year to be corrected.

5.

(A)

Wages paid this quarter subject to the law;

(B)

Less wages paid this quarter in excess of $________ per worker this year;

(C)

Wages subject to tax; enter the amount previously reported for this quarter in the as reported column.

Enter the correct amount in the as corrected column.

Note: The as reported amount should include the amount shown on the original return, plus any previous

corrections.

Note: Use the correct taxable wage base applicable to the year being corrected.

1998 - 12,600 1997 - 12,100 1996 - 11,600 1995 - 11,300 1994 - 13,200 1993 - 12,500

6.

Tax due this quarter: Enter the amount previously paid for this quarter in the as reported column. Enter the correct

amount of tax due in the as corrected column.

7.

Additional tax due: If the as corrected amount is greater than the as reported amount in Item 6, enter the amount

of additional tax due.

8.

Interest due: If any additional tax is due, multiply the amount of tax due by the monthly interest rate for each

month or portion thereof, from the due date to the date paid. The monthly interest rate is .5% (.005) through

12-31-97 and .75% (.0075) from 1-1-98 through 6-30-98. The rate is subject to change semi-annually per

G.S. 105-241.1(i) and may be obtained at or by contacting the nearest Employment Security

Commission office.

9.

Penalty - late payment due: If any additional tax is due for this quarter, compute late payment penalty at the rate

of .10 times the amount due. Minimum $5.

10.

Total due: The sum of additional tax due, interest due, and late payment penalty due for this quarter. Indicate in

the spaces provided whether check is attached for additional amount due or refund is due after adjustment.

11.

The remainder of Form NCUI 685 is to be used to correct individual employee’s wages that were previously

reported incorrectly.

Note: Enter only those employees whose wages require correction.

(A)

Enter the Social Security Number used to report the wages. If incorrect, enter the correct number

above the incorrect number.

(B)

Enter the employee’s name.

(C)

Enter the amount of wages previously reported for the employee for this quarter in the as reported

column.

(D)

Enter the correct amount in the as corrected column.

12.

Enter the reason for the adjustment.

13.

Sign and date the form. Mail it to the Employment Security Commission of North Carolina, P. O. Box 26504,

Raleigh, NC 27611, Attention: Tax Department.

Additional forms may be obtained by contacting a field tax auditor at the nearest Employment Security Commission

Office, telephoning us at (919) 733-3459 or downloading from our web site at

Revised 2/98

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1