Contractors' Excisetax Return Worksheet/instructions - South Dakota Department Of Revenue

ADVERTISEMENT

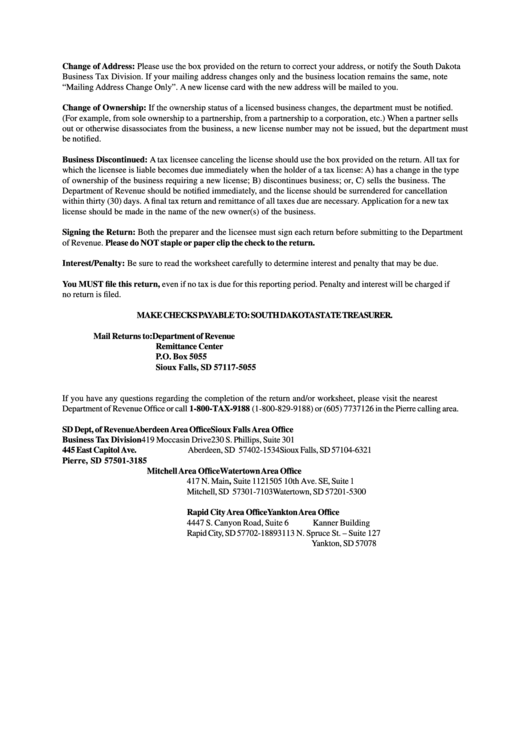

Change of Address: Please use the box provided on the return to correct your address, or notify the South Dakota

Business Tax Division. If your mailing address changes only and the business location remains the same, note

“Mailing Address Change Only”. A new license card with the new address will be mailed to you.

Change of Ownership: If the ownership status of a licensed business changes, the department must be notified.

(For example, from sole ownership to a partnership, from a partnership to a corporation, etc.) When a partner sells

out or otherwise disassociates from the business, a new license number may not be issued, but the department must

be notified.

Business Discontinued: A tax licensee canceling the license should use the box provided on the return. All tax for

which the licensee is liable becomes due immediately when the holder of a tax license: A) has a change in the type

of ownership of the business requiring a new license; B) discontinues business; or, C) sells the business. The

Department of Revenue should be notified immediately, and the license should be surrendered for cancellation

within thirty (30) days. A final tax return and remittance of all taxes due are necessary. Application for a new tax

license should be made in the name of the new owner(s) of the business.

Signing the Return: Both the preparer and the licensee must sign each return before submitting to the Department

of Revenue. Please do NOT staple or paper clip the check to the return.

Interest/Penalty: Be sure to read the worksheet carefully to determine interest and penalty that may be due.

You MUST file this return, even if no tax is due for this reporting period. Penalty and interest will be charged if

no return is filed.

MAKE CHECKS PAYABLE TO: SOUTH DAKOTA STATE TREASURER.

Mail Returns to: Department of Revenue

Remittance Center

P.O. Box 5055

Sioux Falls, SD 57117-5055

If you have any questions regarding the completion of the return and/or worksheet, please visit the nearest

Department of Revenue Office or call 1-800-TAX-9188 (1-800-829-9188) or (605) 7737126 in the Pierre calling area.

SD Dept, of Revenue

Aberdeen Area Office

Sioux Falls Area Office

Business Tax Division

419 Moccasin Drive

230 S. Phillips, Suite 301

445 East Capitol Ave.

Aberdeen, SD 57402-1534

Sioux Falls, SD 57104-6321

Pierre, SD 57501-3185

Mitchell Area Office

Watertown Area Office

417 N. Main, Suite 112

1505 10th Ave. SE, Suite 1

Mitchell, SD 57301-7103

Watertown, SD 57201-5300

Rapid City Area Office

Yankton Area Office

4447 S. Canyon Road, Suite 6

Kanner Building

Rapid City, SD 57702-1889

3113 N. Spruce St. – Suite 127

Yankton, SD 57078

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3