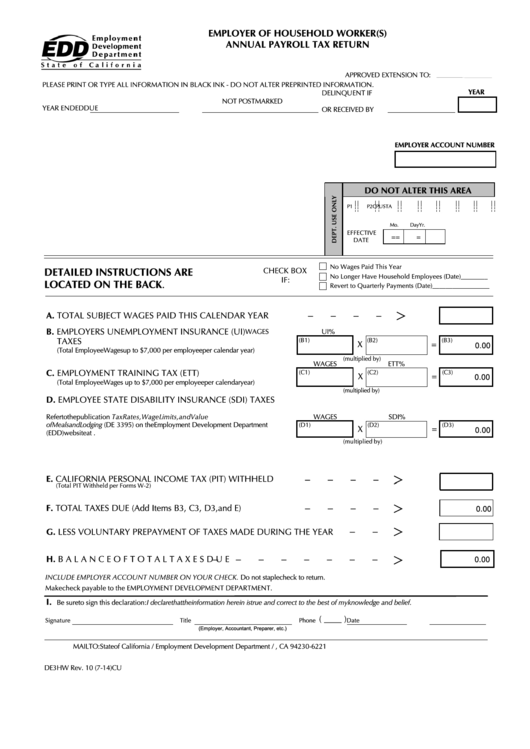

EMPLOYER OF HOUSEHOLD WORKER(S)

ANNUAL PAYROLL TAX RETURN

APPROVED EXTENSION TO:

PLEASE PRINT OR TYPE ALL INFORMATION IN BLACK INK - DO NOT ALTER PREPRINTED INFORMATION.

YEAR

DELINQUENT IF

NOT POSTMARKED

YEAR ENDED

DUE

OR RECEIVED BY

EMPLOYER ACCOUNT NUMBER

DO NOT ALTER THIS AREA

P1

P2

C

P

U

S

T

A

Mo.

Day

Yr.

EFFECTIVE

=

=

=

DATE

No Wages Paid This Year

DETAILED INSTRUCTIONS ARE

CHECK BOX

No Longer Have Household Employees (Date)________

IF:

LOCATED ON THE BACK.

Revert to Quarterly Payments (Date)_________________

_

_

_

_

A. TOTAL SUBJECT WAGES PAID THIS CALENDAR YEAR

B. EMPLOYERS UNEMPLOYMENT INSURANCE (UI)

WAGES

UI%

TAXES

(B1)

(B2)

(B3)

X

=

0.00

(Total Employee Wages up to $7,000 per employee per calendar year)

(multiplied by)

WAGES

ETT%

C. EMPLOYMENT TRAINING TAX (ETT)

(C1)

(C2)

(C3)

X

=

0.00

(Total Employee Wages up to $7,000 per employee per calendar year)

(multiplied by)

D. EMPLOYEE STATE DISABILITY INSURANCE (SDI) TAXES

Refer to the publication Tax Rates, Wage Limits, and Value

WAGES

SDI%

of Meals and Lodging (DE 3395) on the Employment Development Department

(D1)

(D2)

(D3)

X

=

0.00

(EDD) website at

(multiplied by)

_

_

_

_

E. CALIFORNIA PERSONAL INCOME TAX (PIT) WITHHELD

(Total PIT Withheld per Forms W-2)

_

_

_

_

F. TOTAL TAXES DUE (Add Items B3, C3, D3, and E)

0.00

_

_

G. LESS VOLUNTARY PREPAYMENT OF TAXES MADE DURING THE YEAR

_

_

_

_

_

_

_

_

H. BALANCE OF TOTAL TAXES DUE

0.00

INCLUDE EMPLOYER ACCOUNT NUMBER ON YOUR CHECK. Do not staple check to return.

Make check payable to the EMPLOYMENT DEVELOPMENT DEPARTMENT.

I.

Be sure to sign this declaration: I declare that the information herein is true and correct to the best of my knowledge and belief.

( ____ )

Signature

Title

Phone

Date

(Employer, Accountant, Preparer, etc.)

MAIL TO: State of California / Employment Development Department / P.O. Box 826221 / MIC 28B / Sacramento, CA 94230-6221

DE 3HW Rev. 10 (7-14)

CU

1

1