Executive Summary - Memorandum Template

ADVERTISEMENT

Memorandum

Financial Services Department

Date:

November 6, 2009

To:

Mayor and Council

From:

Jerry L. Hart, Financial Services Manager (350-8505)

Subject:

Tax Revenue Statistical Report – October 2009

Attached is the Executive Summary of the Tax Revenue Statistical Report for October 2009 covering September sales

activity reported to our Tax and License Division in October.

Executive Summary of the

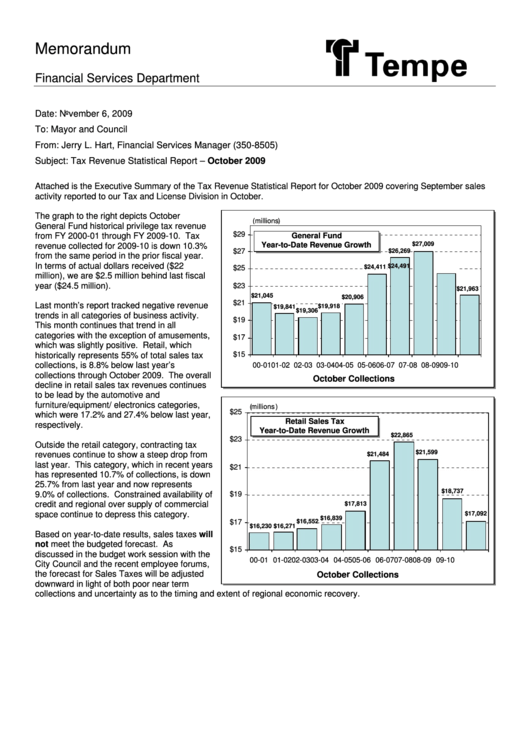

The graph to the right depicts October

(millions)

General Fund historical privilege tax revenue

$29

from FY 2000-01 through FY 2009-10. Tax

General Fund

$27,009

Year-to-Date Revenue Growth

revenue collected for 2009-10 is down 10.3%

$27

$26,269

from the same period in the prior fiscal year.

In terms of actual dollars received ($22

$24,491

$24,411

$25

million), we are $2.5 million behind last fiscal

year ($24.5 million).

$23

$21,963

$21,045

$20,906

$21

Last month’s report tracked negative revenue

$19,918

$19,841

$19,306

trends in all categories of business activity.

$19

This month continues that trend in all

categories with the exception of amusements,

$17

which was slightly positive. Retail, which

$15

historically represents 55% of total sales tax

collections, is 8.8% below last year’s

00-01 01-02 02-03 03-04 04-05 05-06 06-07 07-08 08-09 09-10

collections through October 2009. The overall

October Collections

decline in retail sales tax revenues continues

to be lead by the automotive and

furniture/equipment/ electronics categories,

(millions)

$25

which were 17.2% and 27.4% below last year,

Retail Sales Tax

respectively.

Year-to-Date Revenue Growth

$22,865

$23

Outside the retail category, contracting tax

$21,599

revenues continue to show a steep drop from

$21,484

last year. This category, which in recent years

$21

has represented 10.7% of collections, is down

25.7% from last year and now represents

$18,737

9.0% of collections. Constrained availability of

$19

credit and regional over supply of commercial

$17,813

space continue to depress this category.

$17,092

$16,839

$17

$16,552

$16,230

$16,271

Based on year-to-date results, sales taxes will

not meet the budgeted forecast. As

$15

discussed in the budget work session with the

00-01 01-02 02-03 03-04 04-05 05-06 06-07 07-08 08-09 09-10

City Council and the recent employee forums,

the forecast for Sales Taxes will be adjusted

October Collections

downward in light of both poor near term

collections and uncertainty as to the timing and extent of regional economic recovery.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2