Form Ib-37 - 2007 Additional Local Fire And Lightning Tax Return Property And Casualty Companies

ADVERTISEMENT

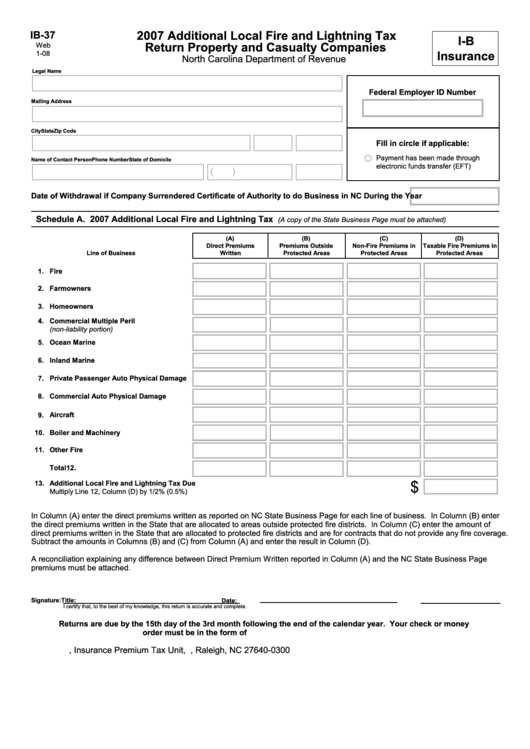

2007 Additional Local Fire and Lightning Tax

IB-37

I-B

Return Property and Casualty Companies

Web

Insurance

1-08

North Carolina Department of Revenue

Legal Name

Federal Employer ID Number

Mailing Address

City

State

Zip Code

Fill in circle if applicable:

Payment has been made through

Name of Contact Person

Phone Number

State of Domicile

electronic funds transfer (EFT)

(

)

Date of Withdrawal if Company Surrendered Certificate of Authority to do Business in NC During the Year

Schedule A. 2007 Additional Local Fire and Lightning Tax

(A copy of the State Business Page must be attached)

(A)

(B)

(C)

(D)

Direct Premiums

Premiums Outside

Non-Fire Premiums in

Taxable Fire Premiums in

Line of Business

Written

Protected Areas

Protected Areas

Protected Areas

Fire

1.

2.

Farmowners

3.

Homeowners

4.

Commercial Multiple Peril

(non-liability portion)

Ocean Marine

5.

6.

Inland Marine

7.

Private Passenger Auto Physical Damage

8.

Commercial Auto Physical Damage

9.

Aircraft

10.

Boiler and Machinery

11.

Other Fire

12.

Total

$

Additional Local Fire and Lightning Tax Due

13.

Multiply Line 12, Column (D) by 1/2% (0.5%)

In Column (A) enter the direct premiums written as reported on NC State Business Page for each line of business. In Column (B) enter

the direct premiums written in the State that are allocated to areas outside protected fire districts. In Column (C) enter the amount of

direct premiums written in the State that are allocated to protected fire districts and are for contracts that do not provide any fire coverage.

Subtract the amounts in Columns (B) and (C) from Column (A) and enter the result in Column (D).

A reconciliation explaining any difference between Direct Premium Written reported in Column (A) and the NC State Business Page

premiums must be attached.

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Returns are due by the 15th day of the 3rd month following the end of the calendar year. Your check or money

order must be in the form of U.S. currency from a domestic bank.

N.C. Department of Revenue, Insurance Premium Tax Unit, P.O. Box 25000, Raleigh, NC 27640-0300

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1