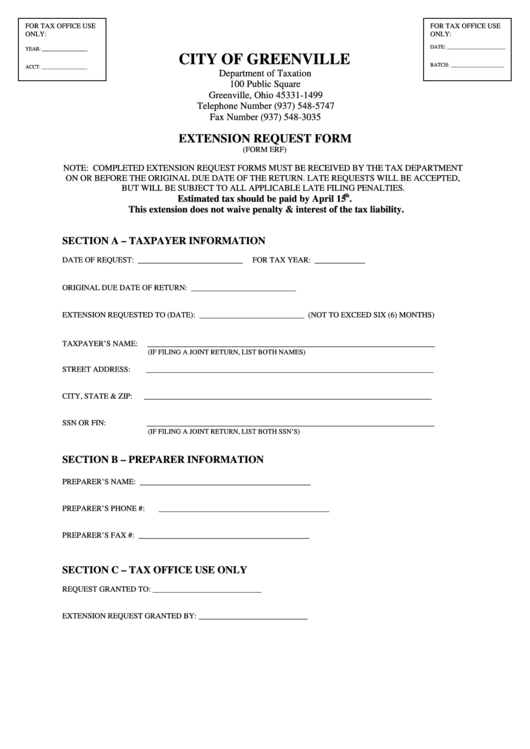

Form Erf - Extension Request Form

ADVERTISEMENT

FOR TAX OFFICE USE

FOR TAX OFFICE USE

ONLY:

ONLY:

DATE: ______________________

YEAR: _________________

CITY OF GREENVILLE

BATCH: ____________________

ACCT: _________________

Department of Taxation

100 Public Square

Greenville, Ohio 45331-1499

Telephone Number (937) 548-5747

Fax Number (937) 548-3035

EXTENSION REQUEST FORM

(FORM ERF)

NOTE: COMPLETED EXTENSION REQUEST FORMS MUST BE RECEIVED BY THE TAX DEPARTMENT

ON OR BEFORE THE ORIGINAL DUE DATE OF THE RETURN. LATE REQUESTS WILL BE ACCEPTED,

BUT WILL BE SUBJECT TO ALL APPLICABLE LATE FILING PENALTIES.

th

Estimated tax should be paid by April 15

.

This extension does not waive penalty & interest of the tax liability.

SECTION A – TAXPAYER INFORMATION

DATE OF REQUEST: ___________________________

FOR TAX YEAR: _____________

ORIGINAL DUE DATE OF RETURN: ___________________________

EXTENSION REQUESTED TO (DATE): ___________________________ (NOT TO EXCEED SIX (6) MONTHS)

TAXPAYER’S NAME:

__________________________________________________________________________

(IF FILING A JOINT RETURN, LIST BOTH NAMES)

STREET ADDRESS:

__________________________________________________________________________

CITY, STATE & ZIP:

__________________________________________________________________________

SSN OR FIN:

__________________________________________________________________________

(IF FILING A JOINT RETURN, LIST BOTH SSN’S)

SECTION B – PREPARER INFORMATION

PREPARER’S NAME:

____________________________________________

PREPARER’S PHONE #:

____________________________________________

PREPARER’S FAX #:

____________________________________________

SECTION C – TAX OFFICE USE ONLY

REQUEST GRANTED TO: ____________________________

EXTENSION REQUEST GRANTED BY:

____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1