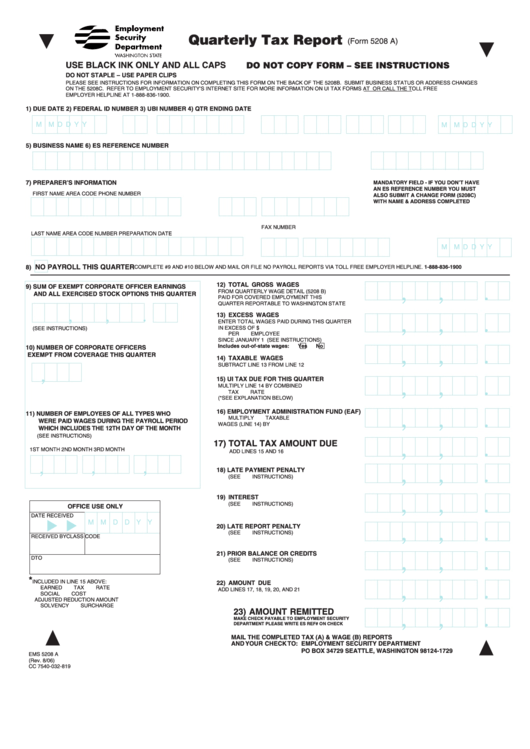

Form 5208 A - Quarterly Tax Report

ADVERTISEMENT

▼

Quarterly Tax Report

▼

(Form 5208 A)

USE BLACK INK ONLY AND ALL CAPS

DO NOT COPY FORM – SEE INSTRUCTIONS

DO NOT STAPLE – USE PAPER CLIPS

PLEASE SEE INSTRUCTIONS FOR INFORMATION ON COMPLETING THIS FORM ON THE BACK OF THE 5208B. SUBMIT BUSINESS STATUS OR ADDRESS CHANGES

ON THE 5208C. REFER TO EMPLOYMENT SECURITY’S INTERNET SITE FOR MORE INFORMATION ON UI TAX FORMS AT OR CALL THE TOLL FREE

EMPLOYER HELPLINE AT 1-888-836-1900.

1) DUE DATE

2) FEDERAL ID NUMBER

3) UBI NUMBER

4) QTR ENDING DATE

M M D

D

Y

Y

M M D

D

Y

Y

5) BUSINESS NAME

6) ES REFERENCE NUMBER

7) PREPARER’S INFORMATION

MANDATORY FIELD - IF YOU DON’T HAVE

AN ES REFERENCE NUMBER YOU MUST

FIRST NAME

AREA CODE

PHONE NUMBER

ALSO SUBMIT A CHANGE FORM (5208C)

WITH NAME & ADDRESS COMPLETED

FAX NUMBER

LAST NAME

AREA CODE

NUMBER

PREPARATION DATE

M M D

D

Y

Y

NO PAYROLL THIS QUARTER

8)

COMPLETE #9 AND #10 BELOW AND MAIL OR FILE NO PAYROLL REPORTS VIA TOLL FREE EMPLOYER HELPLINE. 1-888-836-1900

12) TOTAL GROSS WAGES

9) SUM OF EXEMPT CORPORATE OFFICER EARNINGS

,

,

.

FROM QUARTERLY WAGE DETAIL (5208 B)

AND ALL EXERCISED STOCK OPTIONS THIS QUARTER

PAID FOR COVERED EMPLOYMENT THIS

QUARTER REPORTABLE TO WASHINGTON STATE

,

,

.

13) EXCESS WAGES

,

,

.

ENTER TOTAL WAGES PAID DURING THIS QUARTER

IN EXCESS OF $

(SEE INSTRUCTIONS)

PER EMPLOYEE

SINCE JANUARY 1 (SEE INSTRUCTIONS)

Includes out-of-state wages:

Yes

No

10) NUMBER OF CORPORATE OFFICERS

,

,

.

EXEMPT FROM COVERAGE THIS QUARTER

14) TAXABLE WAGES

SUBTRACT LINE 13 FROM LINE 12

,

15) UI TAX DUE FOR THIS QUARTER

,

,

.

MULTIPLY LINE 14 BY COMBINED

TAX RATE

(*SEE EXPLANATION BELOW)

16) EMPLOYMENT ADMINISTRATION FUND (EAF)

11) NUMBER OF EMPLOYEES OF ALL TYPES WHO

,

,

.

MULTIPLY TAXABLE

WERE PAID WAGES DURING THE PAYROLL PERIOD

WAGES (LINE 14) BY

WHICH INCLUDES THE 12TH DAY OF THE MONTH

(SEE INSTRUCTIONS)

17) TOTAL TAX AMOUNT DUE

,

,

.

1ST MONTH

2ND MONTH

3RD MONTH

ADD LINES 15 AND 16

,

,

,

,

,

.

18) LATE PAYMENT PENALTY

(SEE INSTRUCTIONS)

19) INTEREST

,

,

.

(SEE INSTRUCTIONS)

OFFICE USE ONLY

DATE RECEIVED

M M D

D

Y

Y

20) LATE REPORT PENALTY

,

,

.

(SEE INSTRUCTIONS)

RECEIVED BY

CLASS CODE

21) PRIOR BALANCE OR CREDITS

,

,

.

DTO

(SEE INSTRUCTIONS)

*

INCLUDED IN LINE 15 ABOVE:

22) AMOUNT DUE

,

,

.

EARNED TAX RATE

ADD LINES 17, 18, 19, 20, AND 21

SOCIAL COST

ADJUSTED REDUCTION AMOUNT

SOLVENCY SURCHARGE

23) AMOUNT REMITTED

,

,

.

MAKE CHECK PAYABLE TO EMPLOYMENT SECURITY

DEPARTMENT PLEASE WRITE ES REF# ON CHECK

MAIL THE COMPLETED TAX (A) & WAGE (B) REPORTS

AND YOUR CHECK TO:

EMPLOYMENT SECURITY DEPARTMENT

PO BOX 34729 SEATTLE, WASHINGTON 98124-1729

EMS 5208 A

(Rev. 8/06)

CC 7540-032-819

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1