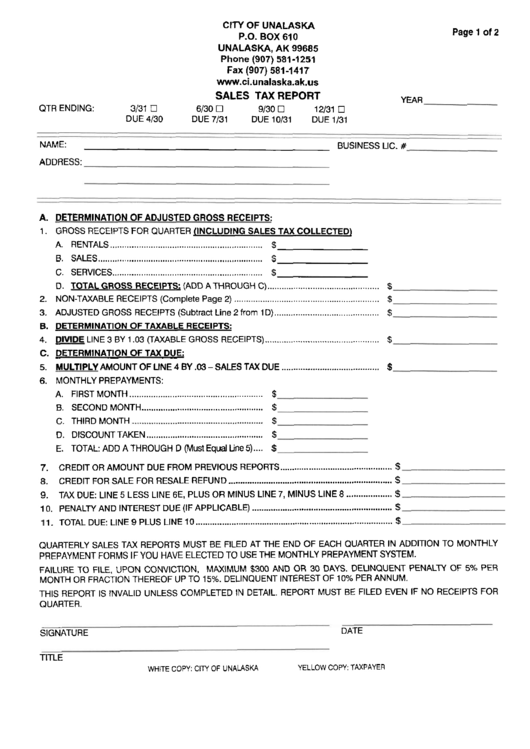

Sales Tax Report Form - City Of Unalaska

ADVERTISEMENT

Page

1

of 2

ClTY

OF

UNALASKA

P.O. BOX

610

UNALASKA, A K 99685

Phone (907) 581-1251

Fax

(907) 581-1417

SALES TAX REPORT

YEAR

QTR ENDING:

3/31

6/30

9/30

12/31

0

DUE 4/30

DUE 7/31

DUE 10131

DUE 1/31

NAME:

BUSINESS LIC. #

ADDRESS:

A. DETERMINATION OF ADJUSTED GROSS RECEIPTS:

1. GROSS RECEIPTS FOR QUARTER (INCLUDING SALES TAX COLLECTED)

A. RENTALS

.....................

. .

......................................

$

8. SALES

.....................................................................

$

C. SERVICES

........... . . . .

......................................

$

D. TOTAL GROSS RECEIPTS: (ADD A THROUGH C)

....................

. .

....................

$

2. NON-TAXABLE RECEIPTS (Complete Page 2)

...................

. .

...................................

$

3. ADJUSTED GROSS RECEIPTS (Subtract Line 2 from 1 D)

..........................................

$

B. DETERMINATION OF TAXABLE RECEIPTS:

4.

LINE 3 BY 1.03 VAXABLE GROSS RECEIPTS)

............................................

$

C. DETERMINATION OF TAX DUE:

5. MULTIPLY AMOUNT OF LINE

4

BY

.03

-

SALES TAX DUE

....................

. . .

............

$

6. MONTHLY PREPAYMENTS:

A. FIRSTMONTH

....................................................

$

..................................................

8. SECOND MONTH

$

C. THIRD MONTH

$

...............................................

D. DISCOUNT TAKEN

$

....

E. TOTAL: ADD A THROUGH D (Must Equal

tine

5)

$

7.

CREDIT OR AMOUNT DUE FROM PRWlOUS REPORTS

..........................................

$

.....................................................................

8.

CREDIT FOR SALE FOR RESALE REFUND

$

...................

9.

TAX DUE: LINE 5 LESS LINE 6E, PLUS OR MINUS LINE 7, MINUS LINE 8

$

...........................................................

10. PENALTY AND INTEREST DUE (IF APPLICABLE)

$

11. TOTAL DUE: LINE 9 PLUS LINE 10

..................................................................................

$

QUARTERLY SALES TAX REPORTS MUST BE FILED AT THE END OF EACH QUARTER IN ADDITION TO MONTHLY

PREPAYMENT FORMS IF YOU HAVE ELECTED TO USE THE MONTHLY PREPAYMENT SYSTEM.

FAILURE TO FILE, UPON CONVICTION, MAXIMUM $300 AND OR 30 DAYS. DELINQUENT PENALTY OF 5% PER

MONTH OR FRACTION THEREOF UP TO 15%. DELINQUENT INTEREST OF 10% PER ANNUM.

THIS REPORT IS INVALID UNLESS COMPLETED IN DETAIL. REPORT MUST BE FILED EVEN IF NO RECEIPTS FOR

QUARTER.

SIGNATURE

DATE

TITLE

WHITE COPY: CITY OF UNALASKA

YELLOW COPY: TAXPAYER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3