Form 27mf - Motor Fuels Election For Electronic Filing And Signature Authorization Form

ADVERTISEMENT

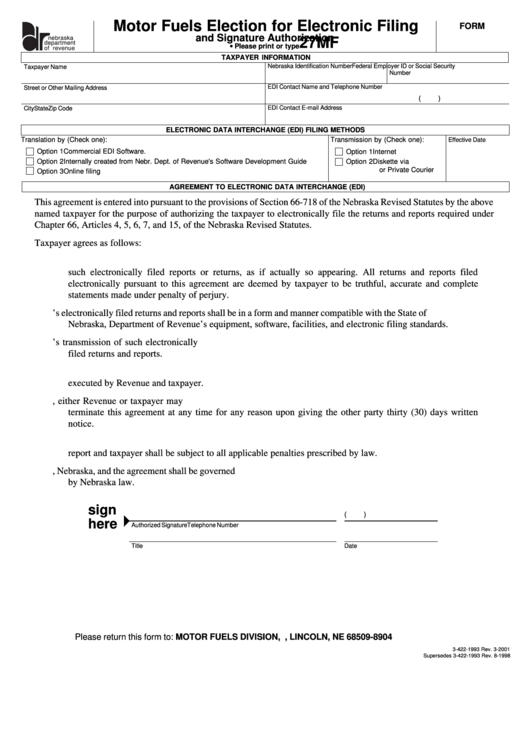

Motor Fuels Election for Electronic Filing

FORM

and Signature Authorization

nebraska

27MF

department

• Please print or type

of revenue

TAXPAYER INFORMATION

Nebraska Identification Number

Federal Employer ID or Social Security

Taxpayer Name

Number

EDI Contact Name and Telephone Number

Street or Other Mailing Address

(

)

EDI Contact E-mail Address

City

State

Zip Code

ELECTRONIC DATA INTERCHANGE (EDI) FILING METHODS

Translation by (Check one):

Transmission by (Check one):

Effective Date

Option 1 Commercial EDI Software.

Option 1 Internet

Option 2 Internally created from Nebr. Dept. of Revenue's Software Development Guide

Option 2 Diskette via U.S. Mail

or Private Courier

Option 3 Online filing

AGREEMENT TO ELECTRONIC DATA INTERCHANGE (EDI)

This agreement is entered into pursuant to the provisions of Section 66-718 of the Nebraska Revised Statutes by the above

named taxpayer for the purpose of authorizing the taxpayer to electronically file the returns and reports required under

Chapter 66, Articles 4, 5, 6, 7, and 15, of the Nebraska Revised Statutes.

Taxpayer agrees as follows:

1. The signature of the taxpayer or its authorized agent affixed to this agreement shall be deemed to appear on

such electronically filed reports or returns, as if actually so appearing. All returns and reports filed

electronically pursuant to this agreement are deemed by taxpayer to be truthful, accurate and complete

statements made under penalty of perjury.

2. Taxpayer’s electronically filed returns and reports shall be in a form and manner compatible with the State of

Nebraska, Department of Revenue’s equipment, software, facilities, and electronic filing standards.

3. Taxpayer shall be responsible for all costs associated with taxpayer’s transmission of such electronically

filed returns and reports.

4. This agreement may be amended at any time by the execution of a written addendum to this agreement

executed by Revenue and taxpayer.

5. Unless required under Section 66-718 of the Nebraska Revised Statutes, either Revenue or taxpayer may

terminate this agreement at any time for any reason upon giving the other party thirty (30) days written

notice.

6. Any electronic filing not in conformity with this agreement shall be deemed a failure to file such return or

report and taxpayer shall be subject to all applicable penalties prescribed by law.

7. The place of performance of this agreement shall be Lincoln, Nebraska, and the agreement shall be governed

by Nebraska law.

sign

(

)

here

Authorized Signature

Telephone Number

Title

Date

Please return this form to: MOTOR FUELS DIVISION, P.O. BOX 98904, LINCOLN, NE 68509-8904

3-422-1993 Rev. 3-2001

Supersedes 3-422-1993 Rev. 8-1998

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1