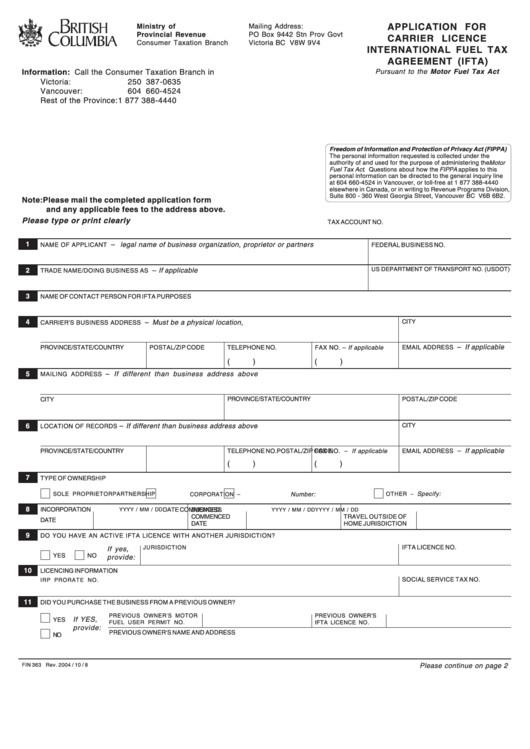

APPLICATION FOR

Ministry of

Mailing Address:

Provincial Revenue

PO Box 9442 Stn Prov Govt

CARRIER LICENCE

Consumer Taxation Branch

Victoria BC V8W 9V4

INTERNATIONAL FUEL TAX

AGREEMENT (IFTA)

Pursuant to the Motor Fuel Tax Act

Information: Call the Consumer Taxation Branch in

Victoria:

250 387-0635

Vancouver:

604 660-4524

Rest of the Province:

1 877 388-4440

Freedom of Information and Protection of Privacy Act (FIPPA)

The personal information requested is collected under the

authority of and used for the purpose of administering the Motor

Fuel Tax Act . Questions about how the FIPPA applies to this

personal information can be directed to the general inquiry line

at 604 660-4524 in Vancouver, or toll-free at 1 877 388-4440

elsewhere in Canada, or in writing to Revenue Programs Division,

Suite 800 - 360 West Georgia Street, Vancouver BC V6B 6B2.

Note: Please mail the completed application form

and any applicable fees to the address above.

Please type or print clearly

TAX ACCOUNT NO.

1

– legal name of business organization, proprietor or partners

NAME OF APPLICANT

FEDERAL BUSINESS NO.

US DEPARTMENT OF TRANSPORT NO. (USDOT)

2

– If applicable

TRADE NAME/DOING BUSINESS AS

3

NAME OF CONTACT PERSON FOR IFTA PURPOSES

4

– Must be a physical location, P.O. Box No. is not acceptable

CITY

CARRIER'S BUSINESS ADDRESS

– If applicable

PROVINCE/STATE/COUNTRY

POSTAL/ZIP CODE

TELEPHONE NO.

FAX NO. – If applicable

EMAIL ADDRESS

(

)

(

)

5

– If different than business address above

MAILING ADDRESS

CITY

PROVINCE/STATE/COUNTRY

POSTAL/ZIP CODE

6

– If different than business address above

CITY

LOCATION OF RECORDS

– If applicable

PROVINCE/STATE/COUNTRY

POSTAL/ZIP CODE

TELEPHONE NO.

FAX NO. – If applicable

EMAIL ADDRESS

(

)

(

)

7

TYPE OF OWNERSHIP

SOLE PROPRIETOR

PARTNERSHIP

Number:

OTHER –

Specify:

CORPORATION –

8

INCORPORATION

BUSINESS

DATE COMMENCED

YYYY / MM / DD

YYYY / MM / DD

YYYY / MM / DD

COMMENCED

TRAVEL OUTSIDE OF

DATE

DATE

HOME JURISDICTION

9

DO YOU HAVE AN ACTIVE IFTA LICENCE WITH ANOTHER JURISDICTION?

JURISDICTION

IFTA LICENCE NO.

If yes,

YES

NO

provide:

10

LICENCING INFORMATION

SOCIAL SERVICE TAX NO.

IRP PRORATE NO.

11

DID YOU PURCHASE THE BUSINESS FROM A PREVIOUS OWNER?

PREVIOUS OWNER'S MOTOR

PREVIOUS OWNER'S

If YES,

YES

FUEL USER PERMIT NO.

IFTA LICENCE NO.

provide:

PREVIOUS OWNER'S NAME AND ADDRESS

NO

FIN 363 Rev. 2004 / 10 / 8

Please continue on page 2

1

1 2

2