Form Ador 25-000 - Tax Clearance Application Form - Arizona Department Of Revenue

ADVERTISEMENT

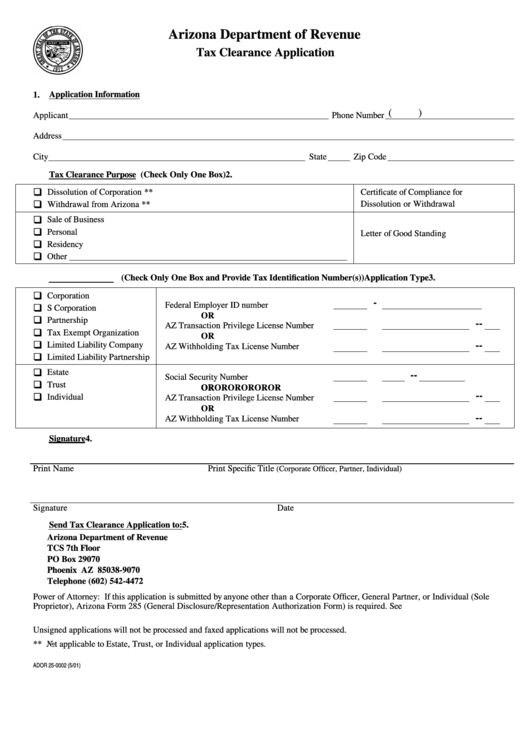

Arizona Department of Revenue

Tax Clearance Application

Application Information

1.

(

)

Applicant

Phone Number

Address

City

State

Zip Code

2.

Tax Clearance Purpose (Check Only One Box)

q

Dissolution of Corporation **

Certificate of Compliance for

q

Dissolution or Withdrawal

Withdrawal from Arizona **

q

Sale of Business

q

Personal

Letter of Good Standing

q

Residency

q

Other

3.

Application Type

(Check Only One Box and Provide Tax Identification Number(s))

q

Corporation

-

Federal Employer ID number

q

S Corporation

OR

q

Partnership

-

-

AZ Transaction Privilege License Number

q

Tax Exempt Organization

OR

q

Limited Liability Company

-

-

AZ Withholding Tax License Number

q

Limited Liability Partnership

q

Estate

-

-

Social Security Number

q

Trust

OR

OR

OR

OR

OR

OR

OR

q

-

-

Individual

AZ Transaction Privilege License Number

OR

-

-

AZ Withholding Tax License Number

4.

Signature

Print Name

Print Specific Title

(Corporate Officer, Partner, Individual)

Signature

Date

5.

Send Tax Clearance Application to:

Arizona Department of Revenue

TCS 7th Floor

PO Box 29070

Phoenix AZ 85038-9070

Telephone (602) 542-4472

Power of Attorney: If this application is submitted by anyone other than a Corporate Officer, General Partner, or Individual (Sole

Proprietor), Arizona Form 285 (General Disclosure/Representation Authorization Form) is required. See

Unsigned applications will not be processed and faxed applications will not be processed.

** Not applicable to Estate, Trust, or Individual application types.

ADOR 25-0002 (5/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1