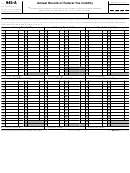

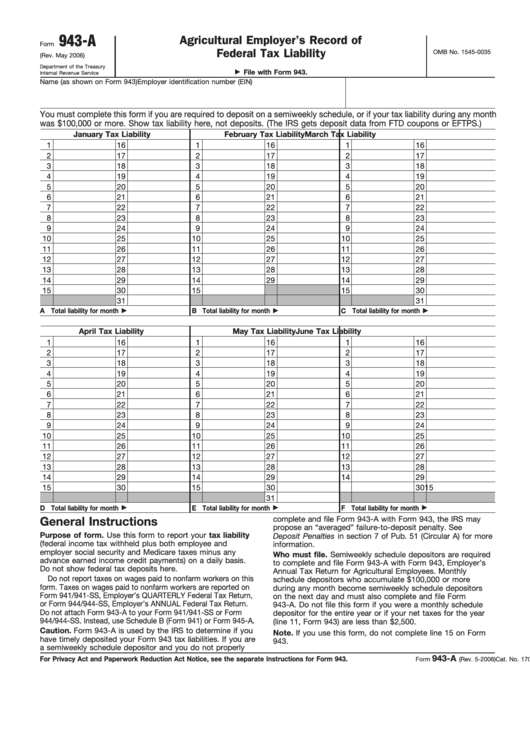

943-A

Agricultural Employer’s Record of

Form

Federal Tax Liability

OMB No. 1545-0035

(Rev. May 2006)

Department of the Treasury

File with Form 943.

Internal Revenue Service

Name (as shown on Form 943)

Employer identification number (EIN)

You must complete this form if you are required to deposit on a semiweekly schedule, or if your tax liability during any month

was $100,000 or more. Show tax liability here, not deposits. (The IRS gets deposit data from FTD coupons or EFTPS.)

January Tax Liability

February Tax Liability

March Tax Liability

1

16

1

16

1

16

2

17

2

17

2

17

3

18

3

18

3

18

4

19

4

19

4

19

5

20

5

20

5

20

6

21

6

21

6

21

7

22

7

22

7

22

8

23

8

23

8

23

9

24

9

24

9

24

10

25

10

25

10

25

11

26

11

26

11

26

12

27

12

27

12

27

13

28

13

28

13

28

14

29

14

29

14

29

15

30

15

15

30

31

31

A Total liability for month

B Total liability for month

C Total liability for month

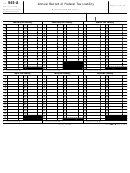

April Tax Liability

May Tax Liability

June Tax Liability

1

16

1

16

1

16

2

17

2

17

2

17

3

18

3

18

3

18

4

19

4

19

4

19

5

20

5

20

5

20

6

21

6

21

6

21

7

22

7

22

7

22

8

23

8

23

8

23

9

24

9

24

9

24

10

25

10

25

10

25

11

26

11

26

11

26

12

27

12

27

12

27

13

28

13

28

13

28

14

29

14

29

14

29

15

30

15

30

15

30

31

D Total liability for month

E Total liability for month

F Total liability for month

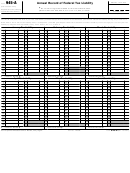

complete and file Form 943-A with Form 943, the IRS may

General Instructions

propose an “averaged” failure-to-deposit penalty. See

Purpose of form. Use this form to report your tax liability

Deposit Penalties in section 7 of Pub. 51 (Circular A) for more

(federal income tax withheld plus both employee and

information.

employer social security and Medicare taxes minus any

Who must file. Semiweekly schedule depositors are required

advance earned income credit payments) on a daily basis.

to complete and file Form 943-A with Form 943, Employer’s

Do not show federal tax deposits here.

Annual Tax Return for Agricultural Employees. Monthly

Do not report taxes on wages paid to nonfarm workers on this

schedule depositors who accumulate $100,000 or more

form. Taxes on wages paid to nonfarm workers are reported on

during any month become semiweekly schedule depositors

Form 941/941-SS, Employer’s QUARTERLY Federal Tax Return,

on the next day and must also complete and file Form

or Form 944/944-SS, Employer’s ANNUAL Federal Tax Return.

943-A. Do not file this form if you were a monthly schedule

Do not attach Form 943-A to your Form 941/941-SS or Form

depositor for the entire year or if your net taxes for the year

944/944-SS. Instead, use Schedule B (Form 941) or Form 945-A.

(line 11, Form 943) are less than $2,500.

Caution. Form 943-A is used by the IRS to determine if you

Note. If you use this form, do not complete line 15 on Form

have timely deposited your Form 943 tax liabilities. If you are

943.

a semiweekly schedule depositor and you do not properly

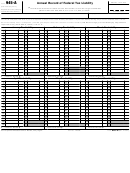

943-A

For Privacy Act and Paperwork Reduction Act Notice, see the separate Instructions for Form 943.

Cat. No. 17030C

Form

(Rev. 5-2006)

1

1 2

2