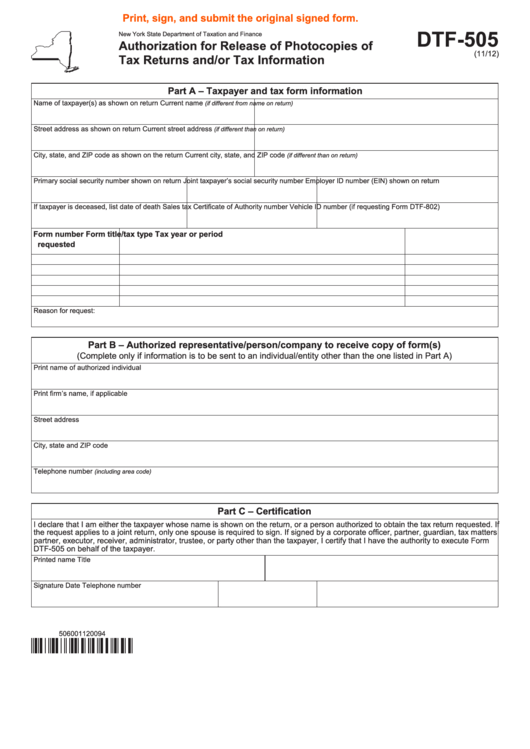

Print, sign, and submit the original signed form.

DTF-505

New York State Department of Taxation and Finance

Authorization for Release of Photocopies of

(11/12)

Tax Returns and/or Tax Information

Part A – Taxpayer and tax form information

Name of taxpayer(s) as shown on return

Current name

(if different from name on return)

Street address as shown on return

Current street address

(if different than on return)

City, state, and ZIP code as shown on the return

Current city, state, and ZIP code

(if different than on return)

Primary social security number shown on return

Joint taxpayer’s social security number

Employer ID number (EIN) shown on return

If taxpayer is deceased, list date of death

Sales tax Certificate of Authority number Vehicle ID number (if requesting Form DTF-802)

Form number

Form title/tax type

Tax year or period

requested

Reason for request:

Part B – Authorized representative/person/company to receive copy of form(s)

(Complete only if information is to be sent to an individual/entity other than the one listed in Part A)

Print name of authorized individual

Print firm’s name, if applicable

Street address

City, state and ZIP code

Telephone number

(including area code)

Part C – Certification

I declare that I am either the taxpayer whose name is shown on the return, or a person authorized to obtain the tax return requested. If

the request applies to a joint return, only one spouse is required to sign. If signed by a corporate officer, partner, guardian, tax matters

partner, executor, receiver, administrator, trustee, or party other than the taxpayer, I certify that I have the authority to execute Form

DTF-505 on behalf of the taxpayer.

Printed name

Title

Signature

Date

Telephone number

506001120094

1

1