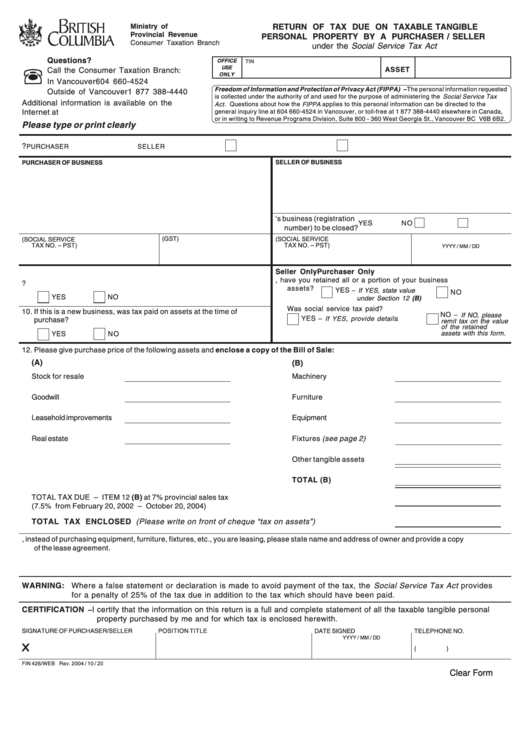

Ministry of

RETURN OF TAX DUE ON TAXABLE TANGIBLE

Provincial Revenue

PERSONAL PROPERTY BY A PURCHASER / SELLER

Consumer Taxation Branch

under the Social Service Tax Act

Questions?

OFFICE

TIN NO.

REGISTRATION/PROFILE/CASE

USE

ASSET

Call the Consumer Taxation Branch:

ONLY

In Vancouver

604 660-4524

Freedom of Information and Protection of Privacy Act (FIPPA) – The personal information requested

Outside of Vancouver 1 877 388-4440

is collected under the authority of and used for the purpose of administering the Social Service Tax

Additional information is available on the

Act . Questions about how the FIPPA applies to this personal information can be directed to the

Internet at

general inquiry line at 604 660-4524 in Vancouver, or toll-free at 1 877 388-4440 elsewhere in Canada,

or in writing to Revenue Programs Division, Suite 800 - 360 West Georgia St., Vancouver BC V6B 6B2.

Please type or print clearly

1. Are you the purchaser or seller of the business?

PURCHASER

SELLER

2. NAME AND ADDRESS OF PURCHASER OF BUSINESS

5. NAME AND ADDRESS OF SELLER OF BUSINESS

6. Is the seller's business (registration

YES

NO

number) to be closed?

8. DATE OF TRANSACTION

4. BUSINESS NO. (GST)

7. REGISTRATION NO. (SOCIAL SERVICE

3. REGISTRATION NO. (SOCIAL SERVICE

TAX NO. – PST)

TAX NO. – PST)

YYYY / MM / DD

Purchaser Only

Seller Only

11. If business sold, have you retained all or a portion of your business

9. Is this a previously established business?

assets?

YES

– If YES, state value

NO

YES

NO

under Section 12 (B)

Was social service tax paid?

1

0. If this is a new business, was tax paid on assets at the time of

NO

–

If NO, please

YES

– If YES, provide details :

purchase?

remit tax on the value

of the retained

assets with this form.

YES

NO

12. Please give purchase price of the following assets and enclose a copy of the Bill of Sale:

(A)

(B)

Stock for resale

Machinery

Goodwill

Furniture

Leasehold improvements

Equipment

Real estate

Fixtures (see page 2)

Other tangible assets

TOTAL (B)

TOTAL TAX DUE – ITEM 12 (B) at 7% provincial sales tax

(7.5% from February 20, 2002 – October 20, 2004)

TOTAL TAX ENCLOSED (Please write on front of cheque “tax on assets”)

13. If, instead of purchasing equipment, furniture, fixtures, etc., you are leasing, please state name and address of owner and provide a copy

of the lease agreement.

WARNING: Where a false statement or declaration is made to avoid payment of the tax, the Social Service Tax Act provides

for a penalty of 25% of the tax due in addition to the tax which should have been paid.

CERTIFICATION

I certify that the information on this return is a full and complete statement of all the taxable tangible personal

–

property purchased by me and for which tax is enclosed herewith.

SIGNATURE OF PURCHASER/SELLER

POSITION TITLE

DATE SIGNED

TELEPHONE NO.

YYYY / MM / DD

X

(

)

FIN 426/WEB Rev. 2004 / 10 / 20

Clear Form

1

1 2

2