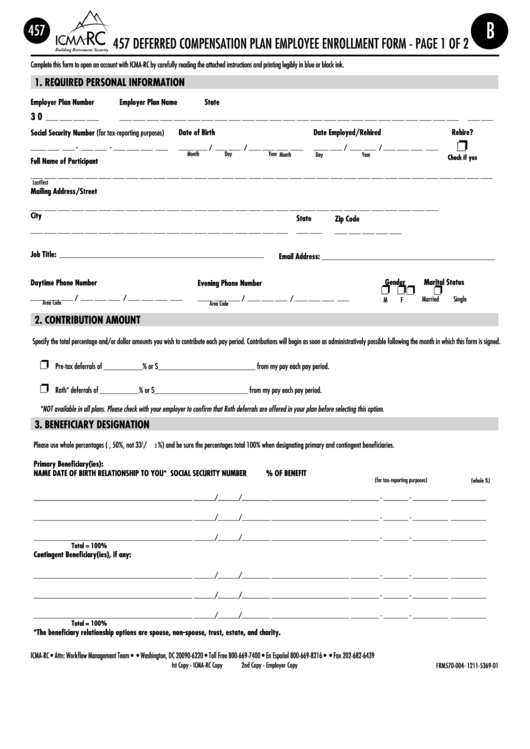

Form 457 - Deferred Compensation Plan Employee Enrollment Form

ADVERTISEMENT

B

457

457 defeRRed CoMpensAtIon pLAn eMpLoYee enRoLLMent foRM - pAge 1 of 2

Complete this form to open an account with ICMA-RC by carefully reading the attached instructions and printing legibly in blue or black ink.

1. requireD PersoNal iNForMatioN

employer Plan Number

employer Plan Name

state

3 0

____ ____ ____ ____

____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____

____ ____

Date of Birth

Date employed/rehired

rehire?

social security Number (for tax-reporting purposes)

❐

_____ ____ ____ - ____ ____ - ____ ____ ____ ____

_____ ____ / ____ ____ / ____ ____ ____ ____

_____ ____ / ____ ____ / ____ ____ ____ ____

Month

day

Year

Month

day

Year

check if yes

Full Name of Participant

____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____

Last

first

M.I.

Mailing address/street

____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____

city

state

Zip code

____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____

____ ____

____ ____ ____ ____ ____

Job title:

__________________________________________________________

email address:

_________________________________________________________

gender

Marital status

Daytime Phone Number

evening Phone Number

❐ ❐

❐

❐

_____ ____ ____ / ____ ____ ____ / ____ ____ ____ ____

_____ ____ ____ / ____ ____ ____ / ____ ____ ____ ____

Married

single

M

f

Area Code

Area Code

2. coNtriButioN aMouNt

specify the total percentage and/or dollar amounts you wish to contribute each pay period. Contributions will begin as soon as administratively possible following the month in which this form is signed.

❐

Pre-tax deferrals of __________% or $_________________________ from my pay each pay period.

❐

Roth* deferrals of __________% or $________________________ from my pay each pay period.

*NOT available in all plans. Please check with your employer to confirm that Roth deferrals are offered in your plan before selecting this option.

3. BeNeFiciary DesigNatioN

Please use whole percentages (e.g., 50%, not 33

/

%) and be sure the percentages total 100% when designating primary and contingent beneficiaries.

1

3

Primary Beneficiary(ies):

NaMe

Date oF Birth

relatioNshiP to you*

social security NuMBer

% oF BeNeFit

(for tax-reporting purposes)

(whole %)

_____________________________________________

______/______/________ ______________________

________ - _______ - __________

__________

_____________________________________________

______/______/________ ______________________

________ - _______ - __________

__________

_____________________________________________

______/______/________ ______________________

________ - _______ - __________

__________

total = 100%

contingent Beneficiary(ies), if any:

_____________________________________________

______/______/________ ______________________

________ - _______ - __________

__________

_____________________________________________

______/______/________ ______________________

________ - _______ - __________

__________

_____________________________________________

______/______/________ ______________________

________ - _______ - __________

__________

total = 100%

*the beneficiary relationship options are spouse, non-spouse, trust, estate, and charity.

ICMA-RC • Attn: Workflow Management Team • P.O. Box 96220 • Washington, DC 20090-6220 • Toll Free 800-669-7400 • En Español 800-669-8216 • • Fax 202-682-6439

Ist Copy - ICMA-RC Copy

2nd Copy - employer Copy

FRM570-004- 1211-5369-01

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3