Form 300 - Gross Production Monthly Tax Report

ADVERTISEMENT

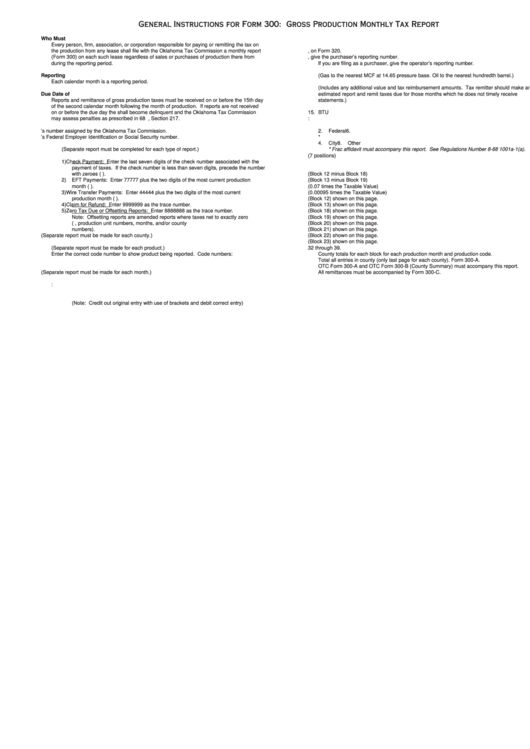

General Instructions for Form 300: Gross Production Monthly Tax Report

Who Must Report...

8.

For company use only.

Every person, firm, association, or corporation responsible for paying or remitting the tax on

9.

Oklahoma Corporation Commission assigned API number.

the production from any lease shall file with the Oklahoma Tax Commission a monthly report

10. Production unit number assigned to the lease by Oklahoma Tax Commission, on Form 320.

(Form 300) on each such lease regardless of sales or purchases of production there from

11. If you are filing as an operator, give the purchaser’s reporting number.

during the reporting period.

If you are filing as a purchaser, give the operator’s reporting number.

12. Gross Volume.

Reporting Period...

(Gas to the nearest MCF at 14.65 pressure base. Oil to the nearest hundredth barrel.)

Each calendar month is a reporting period.

13. Gross Value.

(Includes any additional value and tax reimbursement amounts. Tax remitter should make an

Due Date of Report...

estimated report and remit taxes due for those months which he does not timely receive

Reports and remittance of gross production taxes must be received on or before the 15th day

statements.)

of the second calendar month following the month of production. If reports are not received

14. Gravity of oil produced from lease.

on or before the due day the shall become delinquent and the Oklahoma Tax Commission

15. BTU

may assess penalties as prescribed in 68 O.S. 1971, Section 217.

16. Exemption code:

1.

State School Land Commission

5.

School District

9.

OTC Assigned

1.

Reporting party’s number assigned by the Oklahoma Tax Commission.

2.

Federal

6.

Indian

10.

State

2.

Reporting party’s Federal Employer Identification or Social Security number.

3.

County

*7.

Frac Oil

11.

OCC Authorized

3.

A.

Check appropriate box designating which type of report covered.

4.

City

8.

Other

(Separate report must be completed for each type of report.)

* Frac affidavit must accompany this report. See Regulations Number 8-68 1001a-1(a).

B.

Check/Tracer Number...

17. Decimal equivalent of exempt interest. (7 positions)

1)

Check Payment: Enter the last seven digits of the check number associated with the

18. Volume of exempt interest.

payment of taxes. If the check number is less than seven digits, precede the number

19. Value of exempt interest.

with zeroes (i.e. 0000123).

20. Taxable Volume. (Block 12 minus Block 18)

2)

EFT Payments: Enter 77777 plus the two digits of the most current production

21. Taxable Value. (Block 13 minus Block 19)

month (i.e. 7777701 for January production reports).

22. Gross Production Tax due on oil or gas for each entry. (0.07 times the Taxable Value)

3)

Wire Transfer Payments: Enter 44444 plus the two digits of the most current

23. Petroleum Excise Tax due on oil or gas for each entry. (0.00095 times the Taxable Value)

production month (i.e. 4444401 for January production reports).

24. Total Gross Volume of all entries (Block 12) shown on this page.

4)

Claim for Refund: Enter 9999999 as the trace number.

25. Total Gross Value of all entries (Block 13) shown on this page.

5)

Zero Tax Due or Offsetting Reports: Enter 8888888 as the trace number.

26. Total Exempt Volume of all entries (Block 18) shown on this page.

Note: Offsetting reports are amended reports where taxes net to exactly zero

27. Total Exempt Value of all entries (Block 19) shown on this page.

(i.e. changing product codes, production unit numbers, months, and/or county

28. Total Taxable Volume of all entries (Block 20) shown on this page.

numbers).

29. Total Taxable Value of all entries (Block 21) shown on this page.

4.

Name of county which this report covers. (Separate report must be made for each county.)

30. Total Gross Production Tax due on all entries (Block 22) shown on this page.

5.

Classification of product being reported must be product code show on OTC Form 320.

31. Total Petroleum Excise Tax due on all entries (Block 23) shown on this page.

(Separate report must be made for each product.)

32 through 39.

Enter the correct code number to show product being reported. Code numbers:

County totals for each block for each production month and production code.

1.

Oil

4.

Casinghead Gas

6.

Natural Gas Liquids

Total all entries in county (only last page for each county). Form 300-A.

2.

Condensate

5.

Natural Gas

7.

Minerals

OTC Form 300-A and OTC Form 300-B (County Summary) must accompany this report.

6.

Month and year of production. (Separate report must be made for each month.)

All remittances must be accompanied by Form 300-C.

7.

A.

Number each page consecutively.

B.

Type of report. Report codes:

1.

Original report

3.

Corrected report

(Note: Credit out original entry with use of brackets and debit correct entry)

4.

Payment of take or pay

5.

Production for take or pay previously paid under Type 4

6.

To report and correct all taxes pending regulatory agency rate approval

7.

Report advising settlement of final rate decision of regulatory agency

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1