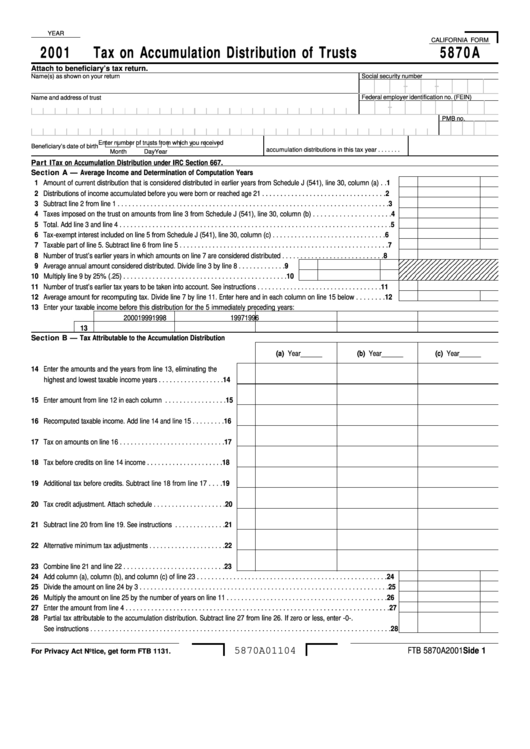

California Form 5870a - Tax On Accumulation Distribution Of Trusts - 2001

ADVERTISEMENT

YEAR

CALIFORNIA FORM

2001

Tax on Accumulation Distribution of Trusts

5870A

Attach to beneficiary’s tax return.

Social security number

Name(s) as shown on your return

-

-

Federal employer identification no. (FEIN)

Name and address of trust

-

PMB no.

Enter number of trusts from which you received

Beneficiary’s date of birth

accumulation distributions in this tax year . . . . . . .

Month

Day

Year

Tax on Accumulation Distribution under IRC Section 667.

Part I

Section A — Average Income and Determination of Computation Years

1 Amount of current distribution that is considered distributed in earlier years from Schedule J (541), line 30, column (a) . .

1

2 Distributions of income accumulated before you were born or reached age 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Taxes imposed on the trust on amounts from line 3 from Schedule J (541), line 30, column (b) . . . . . . . . . . . . . . . . . . . . .

4

5 Total. Add line 3 and line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Tax-exempt interest included on line 5 from Schedule J (541), line 30, column (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Taxable part of line 5. Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Number of trust’s earlier years in which amounts on line 7 are considered distributed . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

9 Average annual amount considered distributed. Divide line 3 by line 8 . . . . . . . . . . . . .

9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

10 Multiply line 9 by 25% (.25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

11 Number of trust’s earlier tax years to be taken into account. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Average amount for recomputing tax. Divide line 7 by line 11. Enter here and in each column on line 15 below . . . . . . . .

12

13 Enter your taxable income before this distribution for the 5 immediately preceding years:

2000

1999

1998

1997

1996

13

Section B — Tax Attributable to the Accumulation Distribution

(a) Year______

(b) Year______

(c) Year______

14 Enter the amounts and the years from line 13, eliminating the

highest and lowest taxable income years . . . . . . . . . . . . . . . . . .

14

15 Enter amount from line 12 in each column . . . . . . . . . . . . . . . . .

15

16 Recomputed taxable income. Add line 14 and line 15 . . . . . . . . .

16

17 Tax on amounts on line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18 Tax before credits on line 14 income . . . . . . . . . . . . . . . . . . . . .

18

19 Additional tax before credits. Subtract line 18 from line 17 . . . .

19

20 Tax credit adjustment. Attach schedule . . . . . . . . . . . . . . . . . . . .

20

21 Subtract line 20 from line 19. See instructions . . . . . . . . . . . . . .

21

22 Alternative minimum tax adjustments . . . . . . . . . . . . . . . . . . . . .

22

23 Combine line 21 and line 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24 Add column (a), column (b), and column (c) of line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25 Divide the amount on line 24 by 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

26 Multiply the amount on line 25 by the number of years on line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

27 Enter the amount from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

28 Partial tax attributable to the accumulation distribution. Subtract line 27 from line 26. If zero or less, enter -0-.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

5870A01104

FTB 5870A 2001 Side 1

For Privacy Act Notice, get form FTB 1131.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2