Form 8332 - Release/revocation Of Release Of Claim To Exemption For Child By Custodial Parent Form

ADVERTISEMENT

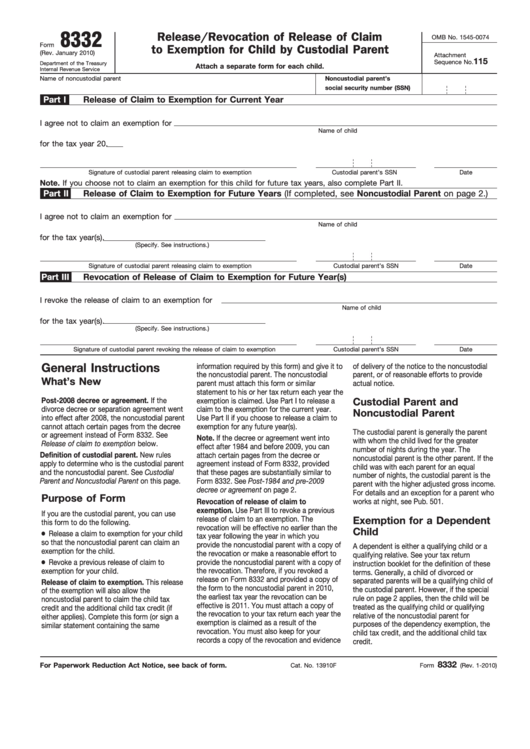

8332

Release/Revocation of Release of Claim

OMB No. 1545-0074

Form

to Exemption for Child by Custodial Parent

(Rev. January 2010)

Attachment

115

Sequence No.

Department of the Treasury

Attach a separate form for each child.

Internal Revenue Service

Name of noncustodial parent

Noncustodial parent’s

social security number (SSN)

Part I

Release of Claim to Exemption for Current Year

I agree not to claim an exemption for

Name of child

for the tax year 20

.

Signature of custodial parent releasing claim to exemption

Custodial parent’s SSN

Date

Note. If you choose not to claim an exemption for this child for future tax years, also complete Part II.

Part II

Release of Claim to Exemption for Future Years (If completed, see Noncustodial Parent on page 2.)

I agree not to claim an exemption for

Name of child

for the tax year(s)

.

(Specify. See instructions.)

Signature of custodial parent releasing claim to exemption

Custodial parent’s SSN

Date

Part III

Revocation of Release of Claim to Exemption for Future Year(s)

I revoke the release of claim to an exemption for

Name of child

for the tax year(s)

.

(Specify. See instructions.)

Signature of custodial parent revoking the release of claim to exemption

Custodial parent’s SSN

Date

General Instructions

information required by this form) and give it to

of delivery of the notice to the noncustodial

the noncustodial parent. The noncustodial

parent, or of reasonable efforts to provide

What’s New

parent must attach this form or similar

actual notice.

statement to his or her tax return each year the

Post-2008 decree or agreement. If the

exemption is claimed. Use Part I to release a

Custodial Parent and

divorce decree or separation agreement went

claim to the exemption for the current year.

Noncustodial Parent

into effect after 2008, the noncustodial parent

Use Part II if you choose to release a claim to

cannot attach certain pages from the decree

exemption for any future year(s).

The custodial parent is generally the parent

or agreement instead of Form 8332. See

Note. If the decree or agreement went into

with whom the child lived for the greater

Release of claim to exemption below.

effect after 1984 and before 2009, you can

number of nights during the year. The

Definition of custodial parent. New rules

attach certain pages from the decree or

noncustodial parent is the other parent. If the

apply to determine who is the custodial parent

agreement instead of Form 8332, provided

child was with each parent for an equal

and the noncustodial parent. See Custodial

that these pages are substantially similar to

number of nights, the custodial parent is the

Parent and Noncustodial Parent on this page.

Form 8332. See Post-1984 and pre-2009

parent with the higher adjusted gross income.

decree or agreement on page 2.

For details and an exception for a parent who

Purpose of Form

works at night, see Pub. 501.

Revocation of release of claim to

exemption. Use Part III to revoke a previous

If you are the custodial parent, you can use

release of claim to an exemption. The

Exemption for a Dependent

this form to do the following.

revocation will be effective no earlier than the

Child

Release a claim to exemption for your child

tax year following the year in which you

so that the noncustodial parent can claim an

provide the noncustodial parent with a copy of

A dependent is either a qualifying child or a

exemption for the child.

the revocation or make a reasonable effort to

qualifying relative. See your tax return

Revoke a previous release of claim to

provide the noncustodial parent with a copy of

instruction booklet for the definition of these

exemption for your child.

the revocation. Therefore, if you revoked a

terms. Generally, a child of divorced or

release on Form 8332 and provided a copy of

separated parents will be a qualifying child of

Release of claim to exemption. This release

the form to the noncustodial parent in 2010,

the custodial parent. However, if the special

of the exemption will also allow the

the earliest tax year the revocation can be

rule on page 2 applies, then the child will be

noncustodial parent to claim the child tax

effective is 2011. You must attach a copy of

treated as the qualifying child or qualifying

credit and the additional child tax credit (if

the revocation to your tax return each year the

relative of the noncustodial parent for

either applies). Complete this form (or sign a

exemption is claimed as a result of the

purposes of the dependency exemption, the

similar statement containing the same

revocation. You must also keep for your

child tax credit, and the additional child tax

records a copy of the revocation and evidence

credit.

8332

For Paperwork Reduction Act Notice, see back of form.

Cat. No. 13910F

Form

(Rev. 1-2010)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1