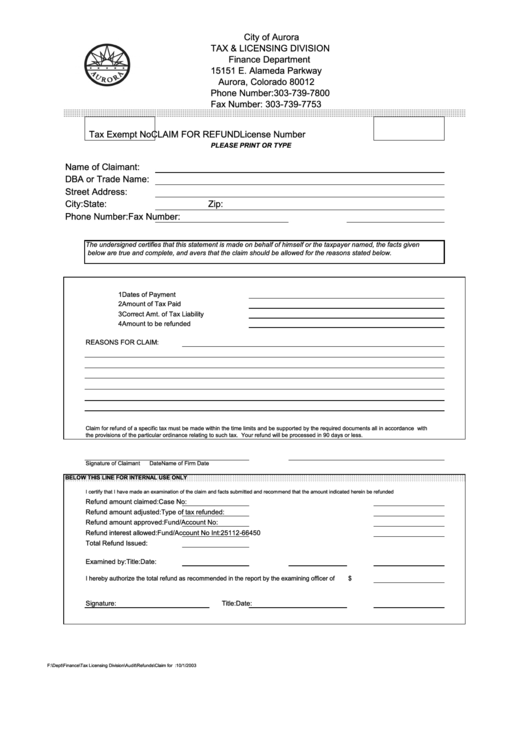

Claim For Refund Form - City Of Aurora, Colorado Finance Department

ADVERTISEMENT

City of Aurora

TAX & LICENSING DIVISION

Finance Department

15151 E. Alameda Parkway

Aurora, Colorado 80012

Phone Number:303-739-7800

Fax Number: 303-739-7753

Tax Exempt No

CLAIM FOR REFUND

License Number

PLEASE PRINT OR TYPE

Name of Claimant:

DBA or Trade Name:

Street Address:

City:

State:

Zip:

Phone Number:

Fax Number:

The undersigned certifies that this statement is made on behalf of himself or the taxpayer named, the facts given

below are true and complete, and avers that the claim should be allowed for the reasons stated below.

1

Dates of Payment

2

Amount of Tax Paid

3

Correct Amt. of Tax Liability

4

Amount to be refunded

REASONS FOR CLAIM:

Claim for refund of a specific tax must be made within the time limits and be supported by the required documents all in accordance with

the provisions of the particular ordinance relating to such tax. Your refund will be processed in 90 days or less.

Signature of Claimant

Date

Name of Firm

Date

BELOW THIS LINE FOR INTERNAL USE ONLY

I certify that I have made an examination of the claim and facts submitted and recommend that the amount indicated herein be refunded

Refund amount claimed:

Case No:

Refund amount adjusted:

Type of tax refunded:

Refund amount approved:

Fund/Account No:

Refund interest allowed:

Fund/Account No Int:

25112-66450

Total Refund Issued:

Examined by:

Title:

Date:

I hereby authorize the total refund as recommended in the report by the examining officer of

$

Signature:

Title:

Date:

F:\Dept\Finance\Tax Licensing Division\Audit\Refunds\Claim for Refund.xls

Revised:10/1/2003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1