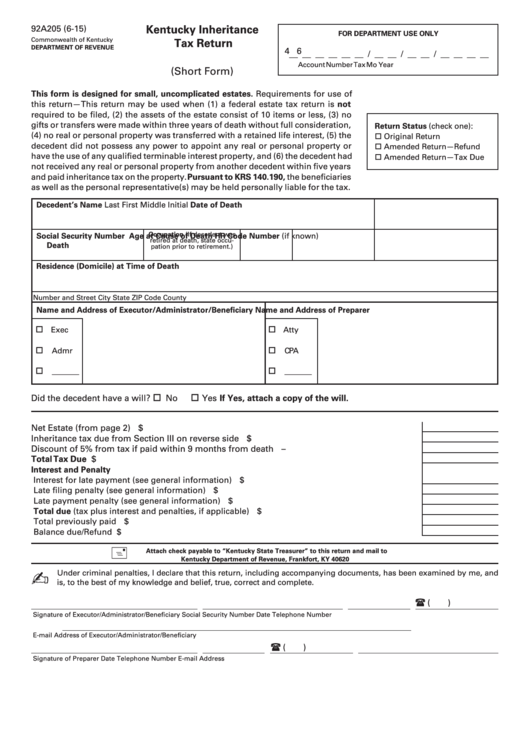

Form 92a205 - Kentucky Inheritance Tax Return - 2015

ADVERTISEMENT

Kentucky Inheritance

92A205 (6-15)

FOR DEPARTMENT USE ONLY

Commonwealth of Kentucky

Tax Return

DEPARTMENT OF REVENUE

4 6

__ __ __ __ __ __ / __ __ / __ __ / __ __ __ __

Account Number

Tax

Mo

Year

(Short Form)

This form is designed for small, uncomplicated estates. Requirements for use of

this return—This return may be used when (1) a federal estate tax return is not

required to be filed, (2) the assets of the estate consist of 10 items or less, (3) no

gifts or transfers were made within three years of death without full consideration,

Return Status (check one):

(4) no real or personal property was transferred with a retained life interest, (5) the

Original Return

decedent did not possess any power to appoint any real or personal property or

Amended Return—Refund

have the use of any qualified terminable interest property, and (6) the decedent had

Amended Return—Tax Due

not received any real or personal property from another decedent within five years

and paid inheritance tax on the property. Pursuant to KRS 140.190, the beneficiaries

as well as the personal representative(s) may be held personally liable for the tax.

Decedent’s Name Last

First

Middle Initial

Date of Death

Occupation (If decedent was

Social Security Number

Age at

Cause of Death

HR Code Number (if known)

retired at death, state occu-

Death

pation prior to retirement.)

Residence (Domicile) at Time of Death

Number and Street

City

State

ZIP Code

County

Name and Address of Executor/Administrator/Beneficiary

Name and Address of Preparer

Exec

Atty

Admr

CPA

_______

_______

Did the decedent have a will?

No

Yes If Yes, attach a copy of the will.

Net Estate (from page 2) ......................................................................................................................

$

Inheritance tax due from Section III on reverse side .........................................................................

$

Discount of 5% from tax if paid within 9 months from death ...........................................................

–

Total Tax Due ........................................................................................................................................

$

Interest and Penalty

Interest for late payment (see general information) ............................................................................... $

Late filing penalty (see general information) ........................................................................................... $

Late payment penalty (see general information) .................................................................................... $

Total due (tax plus interest and penalties, if applicable) ......................................................................... $

Total previously paid .................................................................................................................................. $

Balance due/Refund .................................................................................................................................. $

Attach check payable to “Kentucky State Treasurer” to this return and mail to

Kentucky Department of Revenue, Frankfort, KY 40620

Under criminal penalties, I declare that this return, including accompanying documents, has been examined by me, and

✍

is, to the best of my knowledge and belief, true, correct and complete.

(

)

Signature of Executor/Administrator/Beneficiary

Social Security Number

Date

Telephone Number

E-mail Address of Executor/Administrator/Beneficiary

(

)

Signature of Preparer

Date

Telephone Number

E-mail Address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4