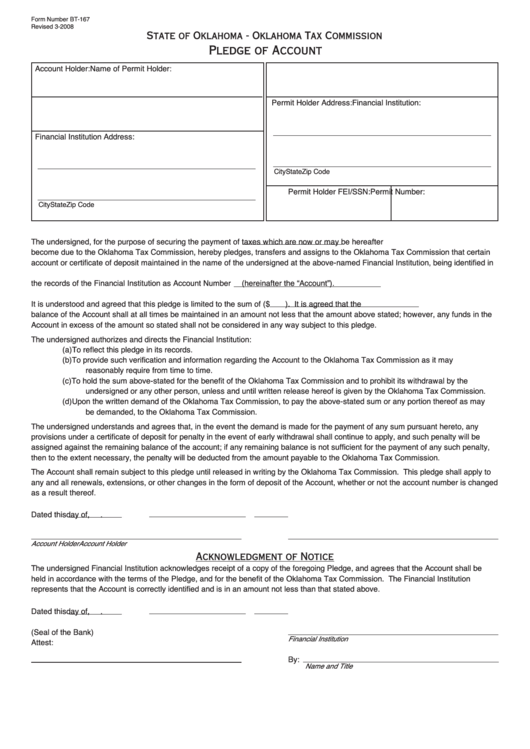

Form Number BT-167

Revised 3-2008

State of Oklahoma - Oklahoma Tax Commission

Pledge of Account

Account Holder:

Name of Permit Holder:

Financial Institution:

Permit Holder Address:

Financial Institution Address:

City

State

Zip Code

Permit Holder FEI/SSN:

Permit Number:

City

State

Zip Code

The undersigned, for the purpose of securing the payment of

taxes which are now or may be hereafter

become due to the Oklahoma Tax Commission, hereby pledges, transfers and assigns to the Oklahoma Tax Commission that certain

account or certificate of deposit maintained in the name of the undersigned at the above-named Financial Institution, being identified in

the records of the Financial Institution as Account Number

(hereinafter the “Account”).

It is understood and agreed that this pledge is limited to the sum of ($

). It is agreed that the

balance of the Account shall at all times be maintained in an amount not less that the amount above stated; however, any funds in the

Account in excess of the amount so stated shall not be considered in any way subject to this pledge.

The undersigned authorizes and directs the Financial Institution:

(a)

To reflect this pledge in its records.

(b)

To provide such verification and information regarding the Account to the Oklahoma Tax Commission as it may

reasonably require from time to time.

(c)

To hold the sum above-stated for the benefit of the Oklahoma Tax Commission and to prohibit its withdrawal by the

undersigned or any other person, unless and until written release hereof is given by the Oklahoma Tax Commission.

(d)

Upon the written demand of the Oklahoma Tax Commission, to pay the above-stated sum or any portion thereof as may

be demanded, to the Oklahoma Tax Commission.

The undersigned understands and agrees that, in the event the demand is made for the payment of any sum pursuant hereto, any

provisions under a certificate of deposit for penalty in the event of early withdrawal shall continue to apply, and such penalty will be

assigned against the remaining balance of the account; if any remaining balance is not sufficient for the payment of any such penalty,

then to the extent necessary, the penalty will be deducted from the amount payable to the Oklahoma Tax Commission.

The Account shall remain subject to this pledge until released in writing by the Oklahoma Tax Commission. This pledge shall apply to

any and all renewals, extensions, or other changes in the form of deposit of the Account, whether or not the account number is changed

as a result thereof.

Dated this

day of

,

.

Account Holder

Account Holder

Acknowledgment of Notice

The undersigned Financial Institution acknowledges receipt of a copy of the foregoing Pledge, and agrees that the Account shall be

held in accordance with the terms of the Pledge, and for the benefit of the Oklahoma Tax Commission. The Financial Institution

represents that the Account is correctly identified and is in an amount not less than that stated above.

Dated this

day of

,

.

(Seal of the Bank)

Financial Institution

Attest:

By:

Name and Title

1

1