Withholding Tax Guide - City Of Grayling - Income Dax Division- 2005

ADVERTISEMENT

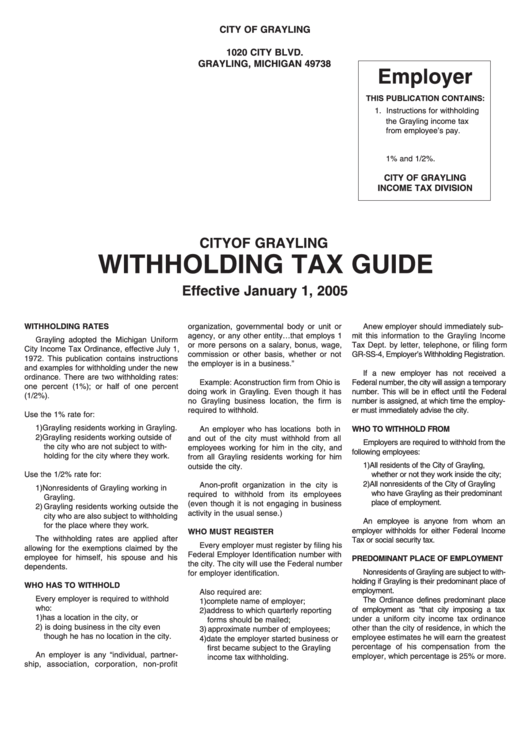

CITY OF GRAYLING

P.O. BOX 549

1020 CITY BLVD.

GRAYLING, MICHIGAN 49738

Employer

THIS PUBLICATION CONTAINS:

1. Instructions for withholding

the Grayling income tax

from employee’s pay.

2. Withholding examples at

1% and 1/2%.

CITY OF GRAYLING

INCOME TAX DIVISION

CITY OF GRAYLING

WITHHOLDING TAX GUIDE

Effective January 1, 2005

WITHHOLDING RATES

organization, governmental body or unit or

A new employer should immediately sub-

agency, or any other entity…that employs 1

mit this information to the Grayling Income

Grayling adopted the Michigan Uniform

or more persons on a salary, bonus, wage,

Tax Dept. by letter, telephone, or filing form

City Income Tax Ordinance, effective July 1,

commission or other basis, whether or not

GR-SS-4, Employer’s Withholding Registration.

1972. This publication contains instructions

the employer is in a business.”

and examples for withholding under the new

If a new employer has not received a

ordinance. There are two withholding rates:

Example: A construction firm from Ohio is

Federal number, the city will assign a temporary

one percent (1%); or half of one percent

doing work in Grayling. Even though it has

number. This will be in effect until the Federal

(1/2%).

no Grayling business location, the firm is

number is assigned, at which time the employ-

required to withhold.

er must immediately advise the city.

Use the 1% rate for:

1) Grayling residents working in Grayling.

WHO TO WITHHOLD FROM

An employer who has locations both in

2) Grayling residents working outside of

and out of the city must withhold from all

Employers are required to withhold from the

the city who are not subject to with-

employees working for him in the city, and

following employees:

holding for the city where they work.

from all Grayling residents working for him

1) All residents of the City of Grayling,

outside the city.

Use the 1/2% rate for:

whether or not they work inside the city;

2) All nonresidents of the City of Grayling

A non-profit organization in the city is

1) Nonresidents of Grayling working in

who have Grayling as their predominant

required to withhold from its employees

Grayling.

place of employment.

(even though it is not engaging in business

2) Grayling residents working outside the

activity in the usual sense.)

city who are also subject to withholding

An employee is anyone from whom an

for the place where they work.

employer withholds for either Federal Income

WHO MUST REGISTER

The withholding rates are applied after

Tax or social security tax.

Every employer must register by filing his

allowing for the exemptions claimed by the

Federal Employer Identification number with

employee for himself, his spouse and his

PREDOMINANT PLACE OF EMPLOYMENT

the city. The city will use the Federal number

dependents.

Nonresidents of Grayling are subject to with-

for employer identification.

holding if Grayling is their predominant place of

WHO HAS TO WITHHOLD

employment.

Also required are:

Every employer is required to withhold

The Ordinance defines predominant place

1) complete name of employer;

who:

of employment as “that city imposing a tax

2) address to which quarterly reporting

1) has a location in the city, or

under a uniform city income tax ordinance

forms should be mailed;

2) is doing business in the city even

other than the city of residence, in which the

3) approximate number of employees;

though he has no location in the city.

employee estimates he will earn the greatest

4) date the employer started business or

percentage of his compensation from the

first became subject to the Grayling

An employer is any “individual, partner-

employer, which percentage is 25% or more.

income tax withholding.

ship, association, corporation, non-profit

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1 2

2 3

3