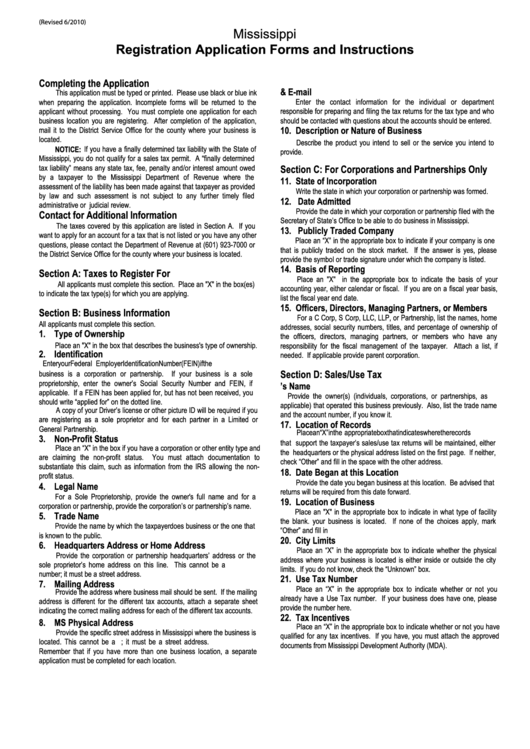

Registration Application Forms And Instructions - Mississippi

ADVERTISEMENT

(Revised 6/2010)

Mississippi

Registration Application Forms and Instructions

Completing the Application

9. Phone Numbers & E-mail

This application must be typed or printed. Please use black or blue ink

when preparing the application. Incomplete forms will be returned to the

Enter the contact information for the individual or department

applicant without processing. You must complete one application for each

responsible for preparing and filing the tax returns for the tax type and who

should be contacted with questions about the accounts should be entered.

business location you are registering. After completion of the application,

10. Description or Nature of Business

mail it to the District Service Office for the county where your business is

located.

Describe the product you intend to sell or the service you intend to

NOTICE: If you have a finally determined tax liability with the State of

provide.

Mississippi, you do not qualify for a sales tax permit. A “finally determined

tax liability” means any state tax, fee, penalty and/or interest amount owed

Section C: For Corporations and Partnerships Only

by a taxpayer to the Mississippi Department of Revenue where the

11. State of Incorporation

assessment of the liability has been made against that taxpayer as provided

Write the state in which your corporation or partnership was formed.

by law and such assessment is not subject to any further timely filed

12. Date Admitted

administrative or judicial review.

Provide the date in which your corporation or partnership filed with the

Contact for Additional Information

Secretary of State’s Office to be able to do business in Mississippi.

The taxes covered by this application are listed in Section A. If you

13. Publicly Traded Company

want to apply for an account for a tax that is not listed or you have any other

Place an “X” in the appropriate box to indicate if your company is one

questions, please contact the Department of Revenue at (601) 923-7000 or

that is publicly traded on the stock market. If the answer is yes, please

the District Service Office for the county where your business is located.

provide the symbol or trade signature under which the company is listed.

14. Basis of Reporting

Section A: Taxes to Register For

Place an "X" in the appropriate box to indicate the basis of your

All applicants must complete this section. Place an "X" in the box(es)

accounting year, either calendar or fiscal. If you are on a fiscal year basis,

to indicate the tax type(s) for which you are applying.

list the fiscal year end date.

15. Officers, Directors, Managing Partners, or Members

Section B: Business Information

For a C Corp, S Corp, LLC, LLP, or Partnership, list the names, home

All applicants must complete this section.

addresses, social security numbers, titles, and percentage of ownership of

1. Type of Ownership

the officers, directors, managing partners, or members who have any

Place an "X" in the box that describes the business's type of ownership.

responsibility for the fiscal management of the taxpayer. Attach a list, if

2. Identification

needed. If applicable provide parent corporation.

Enter your Federal Employer Identification Number (FEIN) if the

business is a corporation or partnership. If your business is a sole

Section D: Sales/Use Tax

proprietorship, enter the owner’s Social Security Number and FEIN, if

16. Previous Owner’s Name

applicable. If a FEIN has been applied for, but has not been received, you

Provide the owner(s) (individuals, corporations, or partnerships, as

should write “applied for” on the dotted line.

applicable) that operated this business previously. Also, list the trade name

A copy of your Driver’s license or other picture ID will be required if you

and the account number, if you know it.

are registering as a sole proprietor and for each partner in a Limited or

17. Location of Records

General Partnership.

Place an “X” in the appropriate box that indicates where the records

3. Non-Profit Status

that support the taxpayer’s sales/use tax returns will be maintained, either

Place an “X” in the box if you have a corporation or other entity type and

the headquarters or the physical address listed on the first page. If neither,

are claiming the non-profit status.

You must attach documentation to

check “Other” and fill in the space with the other address.

substantiate this claim, such as information from the IRS allowing the non-

18. Date Began at this Location

profit status.

Provide the date you began business at this location. Be advised that

4. Legal Name

returns will be required from this date forward.

For a Sole Proprietorship, provide the owner's full name and for a

19. Location of Business

corporation or partnership, provide the corporation’s or partnership’s name.

Place an "X" in the appropriate box to indicate in what type of facility

5. Trade Name

the blank. your business is located. If none of the choices apply, mark

Provide the name by which the taxpayer does business or the one that

“Other” and fill in

is known to the public.

20. City Limits

6. Headquarters Address or Home Address

Place an “X” in the appropriate box to indicate whether the physical

Provide the corporation or partnership headquarters’ address or the

address where your business is located is either inside or outside the city

sole proprietor’s home address on this line. This cannot be a P.O. Box

limits. If you do not know, check the “Unknown” box.

number; it must be a street address.

21. Use Tax Number

7. Mailing Address

Place an “X” in the appropriate box to indicate whether or not you

Provide the address where business mail should be sent. If the mailing

already have a Use Tax number. If your business does have one, please

address is different for the different tax accounts, attach a separate sheet

provide the number here.

indicating the correct mailing address for each of the different tax accounts.

22. Tax Incentives

8. MS Physical Address

Place an “X” in the appropriate box to indicate whether or not you have

Provide the specific street address in Mississippi where the business is

qualified for any tax incentives. If you have, you must attach the approved

located. This cannot be a P.O. Box number; it must be a street address.

documents from Mississippi Development Authority (MDA).

Remember that if you have more than one business location, a separate

application must be completed for each location.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2