Credit For Rehabilitation Of Historic Propertiesworksheet For Tax - 2016

ADVERTISEMENT

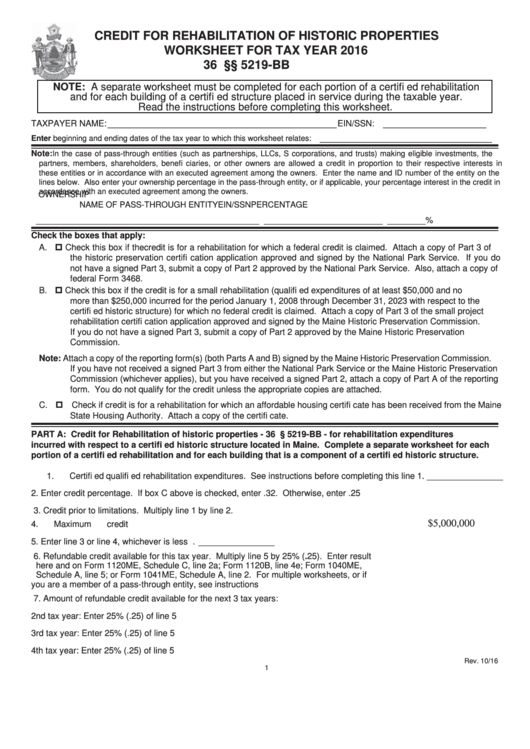

CREDIT FOR REHABILITATION OF HISTORIC PROPERTIES

WORKSHEET FOR TAX YEAR 2016

36 M.R.S. §§ 5219-BB

NOTE: A separate worksheet must be completed for each portion of a certifi ed rehabilitation

and for each building of a certifi ed structure placed in service during the taxable year.

Read the instructions before completing this worksheet.

________________________________________

__________________

TAXPAYER NAME:

EIN/SSN:

______________________________

Enter beginning and ending dates of the tax year to which this worksheet relates:

Note:

In the case of pass-through entities (such as partnerships, LLCs, S corporations, and trusts) making eligible investments, the

partners, members, shareholders, benefi ciaries, or other owners are allowed a credit in proportion to their respective interests in

these entities or in accordance with an executed agreement among the owners. Enter the name and ID number of the entity on the

lines below. Also enter your ownership percentage in the pass-through entity, or if applicable, your percentage interest in the credit in

accordance with an executed agreement among the owners.

OWNERSHIP

NAME OF PASS-THROUGH ENTITY

EIN/SSN

PERCENTAGE

_______________________________________________

_________________________

________%

Check the boxes that apply:

A. Check this box if the credit is for a rehabilitation for which a federal credit is claimed. Attach a copy of Part 3 of

the historic preservation certifi cation application approved and signed by the National Park Service. If you do

not have a signed Part 3, submit a copy of Part 2 approved by the National Park Service. Also, attach a copy of

federal Form 3468.

B. Check this box if the credit is for a small rehabilitation (qualifi ed expenditures of at least $50,000 and no

more than $250,000 incurred for the period January 1, 2008 through December 31, 2023 with respect to the

certifi ed historic structure) for which no federal credit is claimed. Attach a copy of Part 3 of the small project

rehabilitation certifi cation application approved and signed by the Maine Historic Preservation Commission.

If you do not have a signed Part 3, submit a copy of Part 2 approved by the Maine Historic Preservation

Commission.

Note: Attach a copy of the reporting form(s) (both Parts A and B) signed by the Maine Historic Preservation Commission.

If you have not received a signed Part 3 from either the National Park Service or the Maine Historic Preservation

Commission (whichever applies), but you have received a signed Part 2, attach a copy of Part A of the reporting

form. You do not qualify for the credit unless the appropriate copies are attached.

C. Check if credit is for a rehabilitation for which an affordable housing certifi cate has been received from the Maine

State Housing Authority. Attach a copy of the certifi cate.

PART A: Credit for Rehabilitation of historic properties - 36 M.R.S. § 5219-BB - for rehabilitation expenditures

incurred with respect to a certifi ed historic structure located in Maine. Complete a separate worksheet for each

portion of a certifi ed rehabilitation and for each building that is a component of a certifi ed historic structure.

1. Certifi ed qualifi ed rehabilitation expenditures. See instructions before completing this line 1. ________________

2. Enter credit percentage. If box C above is checked, enter .32. Otherwise, enter .25 ........ 2. ________________

3. Credit prior to limitations. Multiply line 1 by line 2. ............................................................... 3. ________________

$5,000,000

4. Maximum credit .................................................................................................................... 4. ________________

5. Enter line 3 or line 4, whichever is less ................................................................................ 5. ________________

6. Refundable credit available for this tax year. Multiply line 5 by 25% (.25). Enter result

here and on Form 1120ME, Schedule C, line 2a; Form 1120B, line 4e; Form 1040ME,

Schedule A, line 5; or Form 1041ME, Schedule A, line 2. For multiple worksheets, or if

you are a member of a pass-through entity, see instructions ............................................... 6. ________________

7. Amount of refundable credit available for the next 3 tax years:

2nd tax year: Enter 25% (.25) of line 5 .................................................................. 7a. ________________

3rd tax year: Enter 25% (.25) of line 5 ................................................................... 7b. ________________

4th tax year: Enter 25% (.25) of line 5 ................................................................... 7c. ________________

Rev. 10/16

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3