Maryland Sales And Use Tax Return Form

ADVERTISEMENT

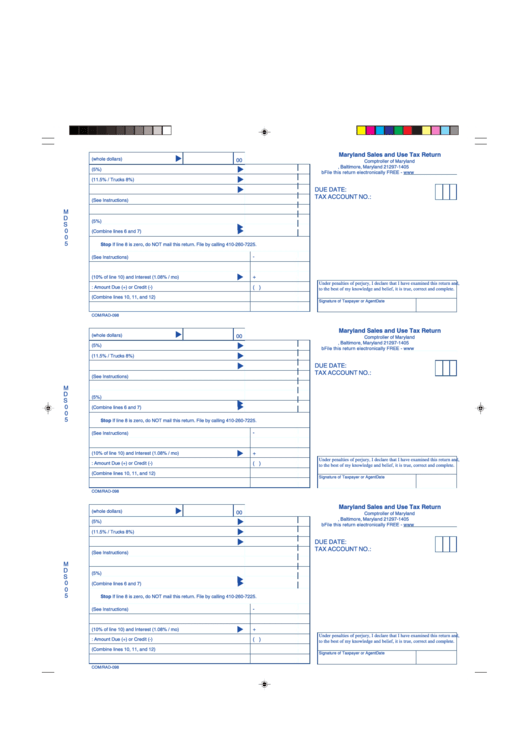

Maryland Sales and Use Tax Return

1.

Gross Sales (whole dollars)

00

Comptroller of Maryland

P.O. Box 17405, Baltimore, Maryland 21297-1405

2.

Tax Due on Sales (5%)

bFile this return electronically FREE -

3.

Tax Due on Car Rentals (11.5% / Trucks 8%)

DUE DATE:

4.

Combine lines 2 and 3

TAX ACCOUNT NO.:

5.

If Timely - Enter Discount (See Instructions)

6.

Subtract line 5 from line 4

M

D

7.

Tax Due on Purchases (5%)

S

0

8.

Total Taxes Due (Combine lines 6 and 7)

0

5

Stop If line 8 is zero, do NOT mail this return. File by calling 410-260-7225.

-

9.

Refund Due (See Instructions)

10. Subtract line 9 from line 8

+

11. If Late - Enter Penalty (10% of line 10) and Interest (1.08% / mo)

Under penalties of perjury, I declare that I have examined this return and,

( )

12. Prior Balance: Amount Due (+) or Credit (-)

to the best of my knowledge and belief, it is true, correct and complete.

13. Balance Due (Combine lines 10, 11, and 12)

Signature of Taxpayer or Agent

Date

14. Amount Enclosed - Make Payable to Comptroller of Maryland - SUT

COM/RAD-098

Maryland Sales and Use Tax Return

1.

Gross Sales (whole dollars)

00

Comptroller of Maryland

P.O. Box 17405, Baltimore, Maryland 21297-1405

2.

Tax Due on Sales (5%)

bFile this return electronically FREE -

3.

Tax Due on Car Rentals (11.5% / Trucks 8%)

DUE DATE:

4.

Combine lines 2 and 3

TAX ACCOUNT NO.:

5.

If Timely - Enter Discount (See Instructions)

6.

Subtract line 5 from line 4

M

D

7.

Tax Due on Purchases (5%)

S

0

8.

Total Taxes Due (Combine lines 6 and 7)

0

5

Stop If line 8 is zero, do NOT mail this return. File by calling 410-260-7225.

-

9.

Refund Due (See Instructions)

10. Subtract line 9 from line 8

11. If Late - Enter Penalty (10% of line 10) and Interest (1.08% / mo)

+

Under penalties of perjury, I declare that I have examined this return and,

12. Prior Balance: Amount Due (+) or Credit (-)

( )

to the best of my knowledge and belief, it is true, correct and complete.

13. Balance Due (Combine lines 10, 11, and 12)

Signature of Taxpayer or Agent

Date

14. Amount Enclosed - Make Payable to Comptroller of Maryland - SUT

COM/RAD-098

Maryland Sales and Use Tax Return

1.

Gross Sales (whole dollars)

00

Comptroller of Maryland

P.O. Box 17405, Baltimore, Maryland 21297-1405

2.

Tax Due on Sales (5%)

bFile this return electronically FREE -

3.

Tax Due on Car Rentals (11.5% / Trucks 8%)

DUE DATE:

4.

Combine lines 2 and 3

TAX ACCOUNT NO.:

5.

If Timely - Enter Discount (See Instructions)

6.

Subtract line 5 from line 4

M

D

7.

Tax Due on Purchases (5%)

S

0

8.

Total Taxes Due (Combine lines 6 and 7)

0

5

Stop If line 8 is zero, do NOT mail this return. File by calling 410-260-7225.

-

9.

Refund Due (See Instructions)

10. Subtract line 9 from line 8

11. If Late - Enter Penalty (10% of line 10) and Interest (1.08% / mo)

+

Under penalties of perjury, I declare that I have examined this return and,

12. Prior Balance: Amount Due (+) or Credit (-)

( )

to the best of my knowledge and belief, it is true, correct and complete.

13. Balance Due (Combine lines 10, 11, and 12)

Signature of Taxpayer or Agent

Date

14. Amount Enclosed - Make Payable to Comptroller of Maryland - SUT

COM/RAD-098

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1