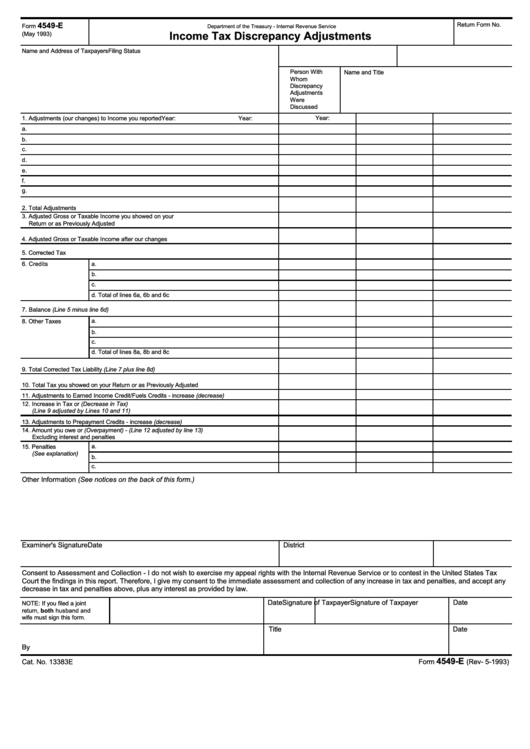

4549-E

Return Form No.

Form

Department of the Treasury - Internal Revenue Service

Income Tax Discrepancy Adjustments

(May 1993)

Name and Address of Taxpayers

S.S. or E.I. Number

Filing Status

Person With

Name and Title

Whom

Discrepancy

Adjustments

Were

Discussed

1. Adjustments (our changes) to Income you reported

Year:

Year:

Year:

a.

b.

c.

d.

e.

f.

g.

2. Total Adjustments

3. Adjusted Gross or Taxable Income you showed on your

Return or as Previously Adjusted

4. Adjusted Gross or Taxable Income after our changes

5. Corrected Tax

a.

6. Credits

b.

c.

d. Total of lines 6a, 6b and 6c

7. Balance (Line 5 minus line 6d)

8. Other Taxes

a.

b.

c.

d. Total of lines 8a, 8b and 8c

9. Total Corrected Tax Liability (Line 7 plus line 8d)

10. Total Tax you showed on your Return or as Previously Adjusted

11. Adjustments to Earned Income Credit/Fuels Credits - increase (decrease)

12. Increase in Tax or (Decrease in Tax)

(Line 9 adjusted by Lines 10 and 11)

13. Adjustments to Prepayment Credits - increase (decrease)

14. Amount you owe or (Overpayment) - (Line 12 adjusted by line 13)

Excluding interest and penalties

a.

15. Penalties

(See explanation)

b.

c.

Other Information (See notices on the back of this form.)

Examiner's Signature

District

Date

Consent to Assessment and Collection - I do not wish to exercise my appeal rights with the Internal Revenue Service or to contest in the United States Tax

Court the findings in this report. Therefore, I give my consent to the immediate assessment and collection of any increase in tax and penalties, and accept any

decrease in tax and penalties above, plus any interest as provided by law.

Signature of Taxpayer

Date

Signature of Taxpayer

Date

NOTE: If you filed a joint

return, both husband and

wife must sign this form.

Title

Date

By

4549-E

Cat. No. 13383E

Form

(Rev- 5-1993)

1

1