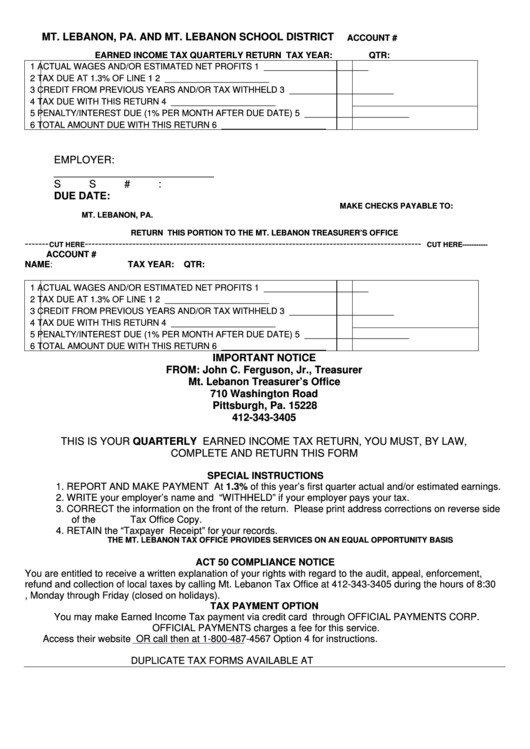

Earned Income Tax Quarterly Return Form - Mt. Lebanon, Pa. And Mt. Lebanon School District

ADVERTISEMENT

MT. LEBANON, PA. AND MT. LEBANON SCHOOL DISTRICT

ACCOUNT #

EARNED INCOME TAX QUARTERLY RETURN

TAX YEAR:

QTR:

1 ACTUAL WAGES AND/OR ESTIMATED NET PROFITS

1 ______________________

2 TAX DUE AT 1.3% OF LINE 1

2 ______________________

3 CREDIT FROM PREVIOUS YEARS AND/OR TAX WITHHELD

3 ______________________

4 TAX DUE WITH THIS RETURN

4 ______________________

5 PENALTY/INTEREST DUE (1% PER MONTH AFTER DUE DATE)

5 ______________________

6 TOTAL AMOUNT DUE WITH THIS RETURN

6 ______________________

EMPLOYER:

____________________________

SS#:

DUE DATE:

MAKE CHECKS PAYABLE TO:

MT. LEBANON, PA.

RETURN THIS PORTION TO THE MT. LEBANON TREASURER’S OFFICE

-------

---------------------------------------------------------------------------------------------------

CUT HERE

CUT HERE-----------

ACCOUNT #

NAME:

TAX YEAR:

QTR:

1 ACTUAL WAGES AND/OR ESTIMATED NET PROFITS

1 ______________________

2 TAX DUE AT 1.3% OF LINE 1

2 ______________________

3 CREDIT FROM PREVIOUS YEARS AND/OR TAX WITHHELD

3 ______________________

4 TAX DUE WITH THIS RETURN

4 ______________________

5 PENALTY/INTEREST DUE (1% PER MONTH AFTER DUE DATE)

5 ______________________

6 TOTAL AMOUNT DUE WITH THIS RETURN

6 ______________________

IMPORTANT NOTICE

FROM: John C. Ferguson, Jr., Treasurer

Mt. Lebanon Treasurer’s Office

710 Washington Road

Pittsburgh, Pa. 15228

412-343-3405

THIS IS YOUR QUARTERLY EARNED INCOME TAX RETURN, YOU MUST, BY LAW,

COMPLETE AND RETURN THIS FORM

SPECIAL INSTRUCTIONS

1. REPORT AND MAKE PAYMENT At 1.3% of this year’s first quarter actual and/or estimated earnings.

2. WRITE your employer’s name and “WITHHELD” if your employer pays your tax.

3. CORRECT the information on the front of the return. Please print address corrections on reverse side

of the

Tax Office Copy.

4. RETAIN the “Taxpayer Receipt” for your records.

THE MT. LEBANON TAX OFFICE PROVIDES SERVICES ON AN EQUAL OPPORTUNITY BASIS

ACT 50 COMPLIANCE NOTICE

You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement,

refund and collection of local taxes by calling Mt. Lebanon Tax Office at 412-343-3405 during the hours of 8:30

A.m. to 5 p.m., Monday through Friday (closed on holidays).

TAX PAYMENT OPTION

You may make Earned Income Tax payment via credit card through OFFICIAL PAYMENTS CORP.

OFFICIAL PAYMENTS charges a fee for this service.

Access their website

OR call then at 1-800-487-4567 Option 4 for instructions.

DUPLICATE TAX FORMS AVAILABLE AT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1