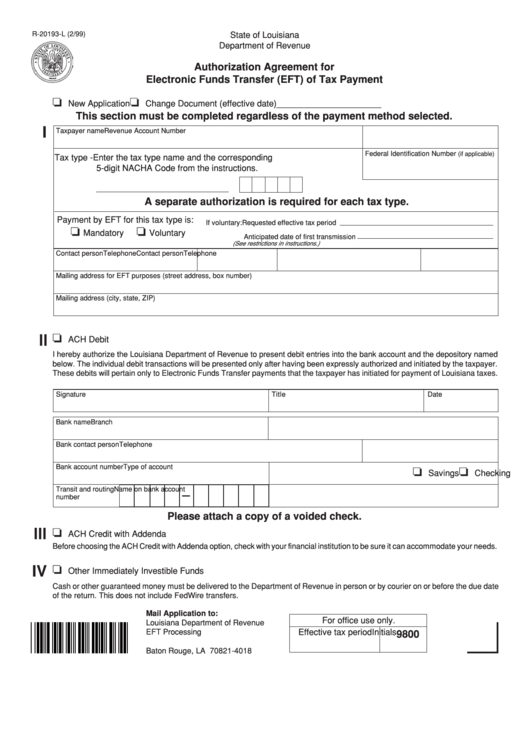

R-20193-L (2/99)

State of Louisiana

Department of Revenue

Authorization Agreement for

Electronic Funds Transfer (EFT) of Tax Payment

❏

❏

New Application

Change Document (effective date) ______________________

This section must be completed regardless of the payment method selected.

I

Taxpayer name

Revenue Account Number

Federal Identification Number

(if applicable)

Tax type - Enter the tax type name and the corresponding

5-digit NACHA Code from the instructions.

A separate authorization is required for each tax type.

Payment by EFT for this tax type is:

If voluntary: Requested effective tax period

❏

❏

Mandatory

Voluntary

Anticipated date of first transmission

(See restrictions in instructions.)

Contact person

Telephone

Contact person

Telephone

Mailing address for EFT purposes (street address, box number)

Mailing address (city, state, ZIP)

❏

ll

ACH Debit

I hereby authorize the Louisiana Department of Revenue to present debit entries into the bank account and the depository named

below. The individual debit transactions will be presented only after having been expressly authorized and initiated by the taxpayer.

These debits will pertain only to Electronic Funds Transfer payments that the taxpayer has initiated for payment of Louisiana taxes.

Signature

Title

Date

Bank name

Branch

Bank contact person

Telephone

Bank account number

Type of account

❏

❏

Checking

Savings

Transit and routing

Name on bank account

–

number

Please attach a copy of a voided check.

❏

lll

ACH Credit with Addenda

Before choosing the ACH Credit with Addenda option, check with your financial institution to be sure it can accommodate your needs.

❏

IV

Other Immediately Investible Funds

Cash or other guaranteed money must be delivered to the Department of Revenue in person or by courier on or before the due date

of the return. This does not include FedWire transfers.

Mail Application to:

For office use only.

Louisiana Department of Revenue

Effective tax period

Initials

EFT Processing

9800

P.O. Box 4018

Baton Rouge, LA 70821-4018

1

1