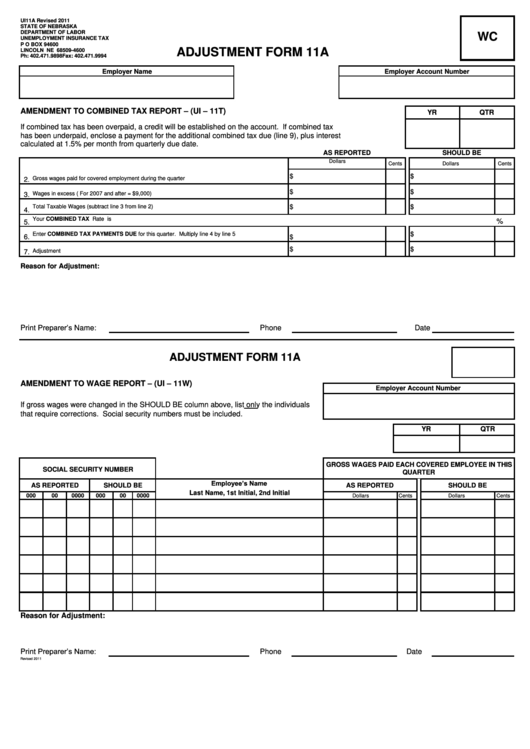

Adjustment Form 11a - Amendment To Combined Tax Report

ADVERTISEMENT

UI11A Revised 2011

STATE OF NEBRASKA

DEPARTMENT OF LABOR

WC

UNEMPLOYMENT INSURANCE TAX

P O BOX 94600

ADJUSTMENT FORM 11A

LINCOLN NE 68509-4600

Ph: 402.471.9898

Fax: 402.471.9994

Employer Name

Employer Account Number

AMENDMENT TO COMBINED TAX REPORT – (UI – 11T)

YR

QTR

If combined tax has been overpaid, a credit will be established on the account. If combined tax

has been underpaid, enclose a payment for the additional combined tax due (line 9), plus interest

calculated at 1.5% per month from quarterly due date.

AS REPORTED

SHOULD BE

Dollars

Cents

Dollars

Cents

$

$

2.

Gross wages paid for covered employment during the quarter

$

$

Wages in excess ( For 2007 and after = $9,000)

3.

$

$

Total Taxable Wages (subtract line 3 from line 2)

4.

%

Your COMBINED TAX Rate is

5.

$

Enter COMBINED TAX PAYMENTS DUE for this quarter. Multiply line 4 by line 5

6.

$

$

$

Adjustment

7.

Reason for Adjustment:

Print Preparer’s Name:

Phone

Date

ADJUSTMENT FORM 11A

AMENDMENT TO WAGE REPORT – (UI – 11W)

Employer Account Number

If gross wages were changed in the SHOULD BE column above, list only the individuals

that require corrections. Social security numbers must be included.

YR

QTR

GROSS WAGES PAID EACH COVERED EMPLOYEE IN THIS

SOCIAL SECURITY NUMBER

QUARTER

Employee’s Name

AS REPORTED

SHOULD BE

AS REPORTED

SHOULD BE

Last Name, 1st Initial, 2nd Initial

000

00

0000

000

00

0000

Dollars

Cents

Dollars

Cents

Reason for Adjustment:

Print Preparer’s Name:

Phone

Date

Revised 2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1