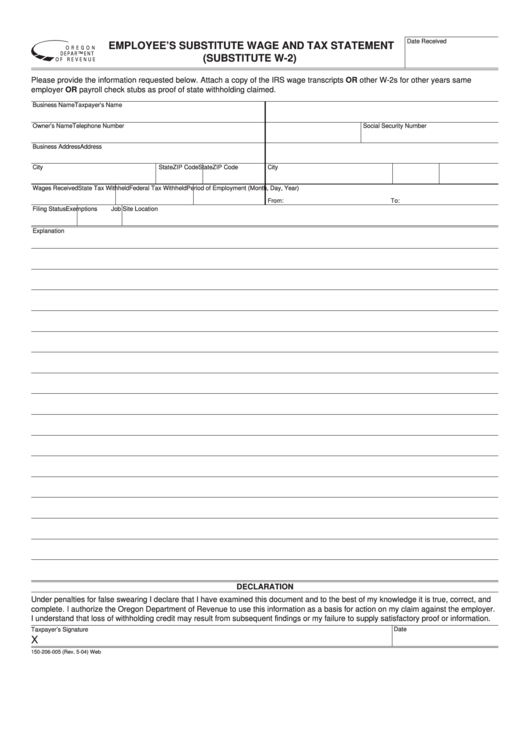

Form 150-206-005 (Subtitute W-2) -Employee'S Substitute Wage And Tax Statement - Oregon Department Of Revenue

ADVERTISEMENT

Date Received

EMPLOYEE’S SUBSTITUTE WAGE AND TAX STATEMENT

O R E G O N

D E PA R T M E N T

(SUBSTITUTE W-2)

O F R E V E N U E

Please provide the information requested below. Attach a copy of the IRS wage transcripts OR other W-2s for other years same

employer OR payroll check stubs as proof of state withholding claimed.

Business Name

Taxpayer’s Name

Owner’s Name

Telephone Number

Social Security Number

Business Address

Address

City

State

ZIP Code

City

State

ZIP Code

Wages Received

State Tax Withheld

Federal Tax Withheld

Period of Employment (Month, Day, Year)

From:

To:

Filing Status

Exemptions

Job Site Location

Explanation

DECLARATION

Under penalties for false swearing I declare that I have examined this document and to the best of my knowledge it is true, correct, and

complete. I authorize the Oregon Department of Revenue to use this information as a basis for action on my claim against the employer.

I understand that loss of withholding credit may result from subsequent findings or my failure to supply satisfactory proof or information.

Date

Taxpayer’s Signature

X

150-206-005 (Rev. 5-04) Web

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1