Print

Clear

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

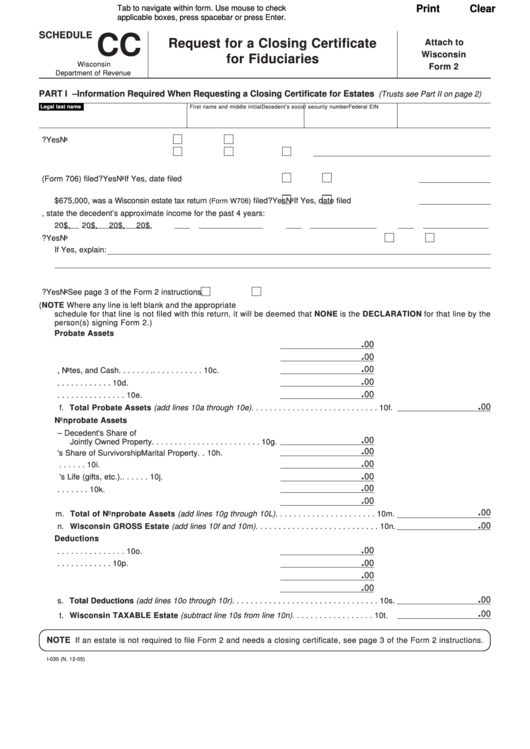

SCHEDULE

CC

Request for a Closing Certificate

Attach to

Wisconsin

for Fiduciaries

Wisconsin

Form 2

Department of Revenue

PART I – Information Required When Requesting a Closing Certificate for Estates

(Trusts see Part II on page 2)

Legal last name

First name and middle initial

Decedent’s social security number

Federal EIN

1. Did the decedent have a will?

Yes

No

2. Type of probate

Formal

Informal

Other

3. Attach a copy of the inventory and will.

4. Was a federal estate tax return (Form 706) filed?

Yes

No

If Yes, date filed

5. If the gross estate plus adjusted taxable gifts was more than

$675,000, was a Wisconsin estate tax return

filed?

Yes

No

If Yes, date filed

(Form W706)

6. If the decedent did not file tax returns prior to death, state the decedent’s approximate income for the past 4 years:

20

$

,

20

$

,

20

$

,

20

$

.

7. Was the decedent contacted by the IRS and/or Wis. Dept. of Revenue in the last 3 years?

Yes

No

If Yes, explain:

8. Attach a copy of the final account to the final Form 2.

9. Is a certificate required by the court?

Yes

No

See page 3 of the Form 2 instructions.

10. Enter the totals of each of the assets and deductions listed below. (NOTE Where any line is left blank and the appropriate

schedule for that line is not filed with this return, it will be deemed that NONE is the DECLARATION for that line by the

person(s) signing Form 2.)

Probate Assets

.

00

a. Real Estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10a.

.

00

b. Stocks and Bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10b.

.

00

c. Mortgages, Notes, and Cash . . . . . . . . . . . . . . . . . . . 10c.

.

00

d. Insurance Payable to Estate . . . . . . . . . . . . . . . . . . . . 10d.

.

00

e. Other Miscellaneous Property . . . . . . . . . . . . . . . . . . 10e.

.

00

f. Total Probate Assets (add lines 10a through 10e) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10f.

Nonprobate Assets

g. Jointly Owned Survivorship – Decedent's Share of

.

00

Jointly Owned Property . . . . . . . . . . . . . . . . . . . . . . . . 10g.

.

00

h. Decedent's Share of Survivorship Marital Property . . 10h.

.

00

i. Insurance Payable to Named Beneficiaries . . . . . . . .

10i.

.

00

j. Transfers During Decedent's Life (gifts, etc.) . . . . . . .

10j.

.

00

k. Annuities and Employee Death Benefits . . . . . . . . . . 10k.

.

00

L. Other Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10L.

.

00

m. Total of Nonprobate Assets (add lines 10g through 10L) . . . . . . . . . . . . . . . . . . . . . . 10m.

.

00

n. Wisconsin GROSS Estate (add lines 10f and 10m) . . . . . . . . . . . . . . . . . . . . . . . . . . . 10n.

Deductions

.

00

o. Funeral Expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10o.

.

00

p. Administration Expenses . . . . . . . . . . . . . . . . . . . . . . 10p.

.

00

q. Debts of Decedent . . . . . . . . . . . . . . . . . . . . . . . . . . . 10q.

.

00

r. Mortgages and Liens . . . . . . . . . . . . . . . . . . . . . . . . . .

10r.

.

00

s. Total Deductions (add lines 10o through 10r) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10s.

.

00

t. Wisconsin TAXABLE Estate (subtract line 10s from line 10n) . . . . . . . . . . . . . . . . . .

10t.

NOTE

If an estate is not required to file Form 2 and needs a closing certificate, see page 3 of the Form 2 instructions.

I-030 (N. 12-05)

1

1 2

2