Form 503 - Refund Payment Order Under The Maharashtra Value Added Tax Act, 2002

ADVERTISEMENT

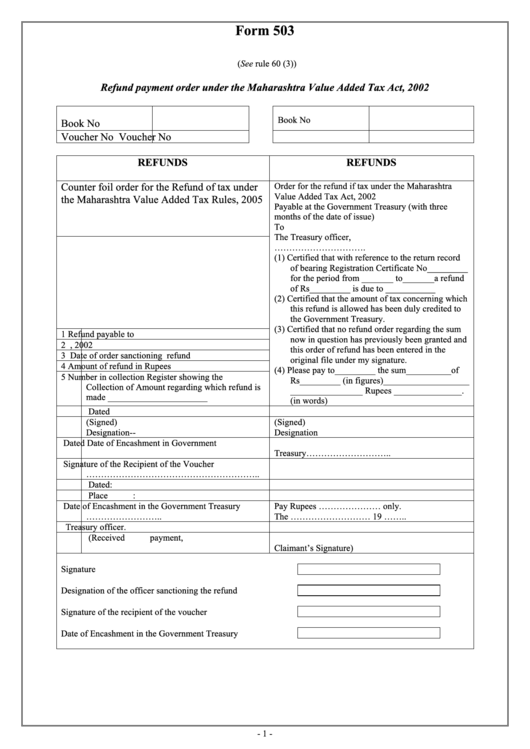

Form 503

(See rule 60 (3))

Refund payment order under the Maharashtra Value Added Tax Act, 2002

Book No

Book No

Voucher No

Voucher No

REFUNDS

REFUNDS

Counter foil order for the Refund of tax under

Order for the refund if tax under the Maharashtra

Value Added Tax Act, 2002

the Maharashtra Value Added Tax Rules, 2005

Payable at the Government Treasury (with three

months of the date of issue)

To

The Treasury officer,

………………………….

(1) Certified that with reference to the return record

of bearing Registration Certificate No_________

for the period from _______ to_______a refund

of Rs_________ is due to ___________

(2) Certified that the amount of tax concerning which

this refund is allowed has been duly credited to

the Government Treasury.

(3) Certified that no refund order regarding the sum

1

Refund payable to

now in question has previously been granted and

2

R.C. No. under MVAT Act, 2002

this order of refund has been entered in the

3

Date of order sanctioning refund

original file under my signature.

4

Amount of refund in Rupees

(4) Please pay to_________ the sum__________of

5

Number in collection Register showing the

Rs_________ (in figures)___________________

Collection of Amount regarding which refund is

________________ Rupees _______________.

made ______________________

(in words)

Dated

(Signed)

(Signed)

Designation--

Designation

Dated

Date of Encashment in Government

Treasury………………………..

Signature of the Recipient of the Voucher

…………………………………………………..

Dated:

Place :

Date of Encashment in the Government Treasury

Pay Rupees ………………… only.

……………………..

The ……………………… 19 ……..

Treasury officer.

(Received payment,

Claimant’s Signature)

Signature

Designation of the officer sanctioning the refund

Signature of the recipient of the voucher

Date of Encashment in the Government Treasury

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1