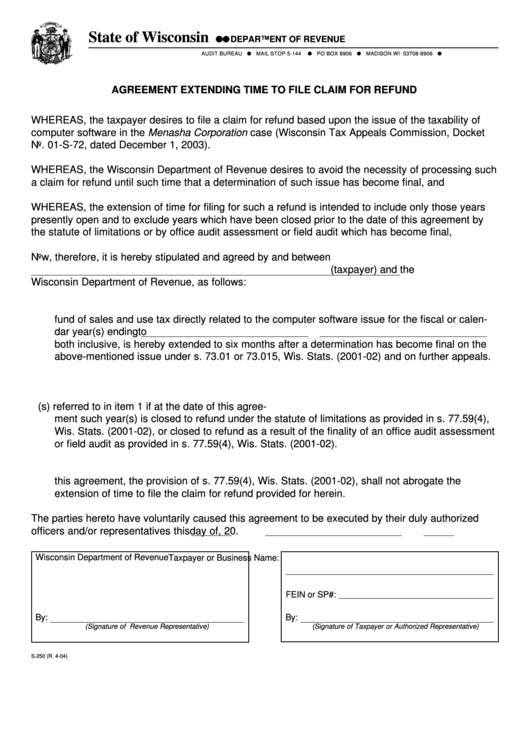

Form S-250 - Agreement Extending Time To File Claim For Refund

ADVERTISEMENT

State of Wisconsin

● ● ● ● ● DEPARTMENT OF REVENUE

AUDIT BUREAU ●

●

PO BOX 8906 ●

MADISON WI 53708-8906 ●

MAIL STOP 5-144

AGREEMENT EXTENDING TIME TO FILE CLAIM FOR REFUND

WHEREAS, the taxpayer desires to file a claim for refund based upon the issue of the taxability of

computer software in the Menasha Corporation case (Wisconsin Tax Appeals Commission, Docket

No. 01-S-72, dated December 1, 2003).

WHEREAS, the Wisconsin Department of Revenue desires to avoid the necessity of processing such

a claim for refund until such time that a determination of such issue has become final, and

WHEREAS, the extension of time for filing for such a refund is intended to include only those years

presently open and to exclude years which have been closed prior to the date of this agreement by

the statute of limitations or by office audit assessment or field audit which has become final,

Now, therefore, it is hereby stipulated and agreed by and between

(taxpayer) and the

Wisconsin Department of Revenue, as follows:

1. The time provided under Wisconsin Statutes within which the taxpayer may file a claim for re-

fund of sales and use tax directly related to the computer software issue for the fiscal or calen-

dar year(s) ending

to

both inclusive, is hereby extended to six months after a determination has become final on the

above-mentioned issue under s. 73.01 or 73.015, Wis. Stats. (2001-02) and on further appeals.

2. The claim for refund shall be limited to a claim solely based upon the above-mentioned issue.

3. This agreement shall not apply to any year(s) referred to in item 1 if at the date of this agree-

ment such year(s) is closed to refund under the statute of limitations as provided in s. 77.59(4),

Wis. Stats. (2001-02), or closed to refund as a result of the finality of an office audit assessment

or field audit as provided in s. 77.59(4), Wis. Stats. (2001-02).

4. In the event an office audit assessment or a field audit becomes final subsequent to the date of

this agreement, the provision of s. 77.59(4), Wis. Stats. (2001-02), shall not abrogate the

extension of time to file the claim for refund provided for herein.

The parties hereto have voluntarily caused this agreement to be executed by their duly authorized

officers and/or representatives this

day of

, 20

.

Wisconsin Department of Revenue

Taxpayer or Business Name:

FEIN or SP#:

By:

By:

(Signature of Revenue Representative)

(Signature of Taxpayer or Authorized Representative)

S-250 (R. 4-04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1