Form Hw-020 - State Form 46244 - Hazardous Waste Disposal Tax Return

ADVERTISEMENT

Ii

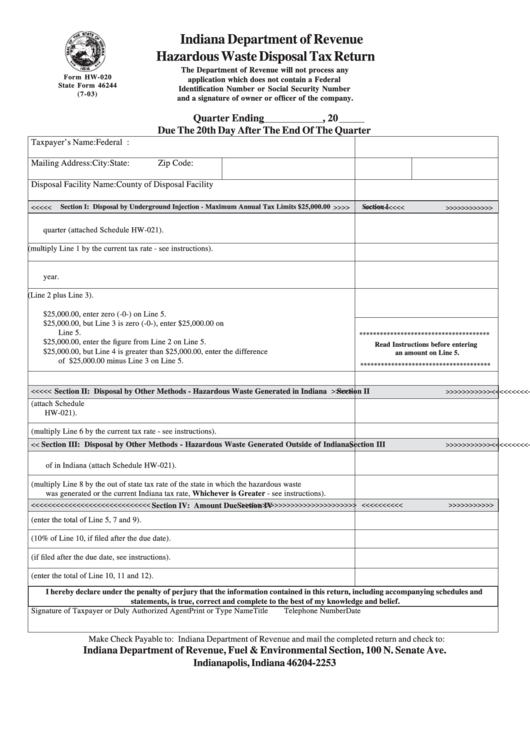

iIndiana Department of Revenue

Hazardous Waste Disposal Tax Return

The Department of Revenue will not process any

Form HW-020

application which does not contain a Federal

State Form 46244

Identification Number or Social Security Number

(7-03)

and a signature of owner or officer of the company.

Quarter Ending

, 20

Due The 20th Day After The End Of The Quarter

Taxpayer’s Name:

Federal I.D. Number:

Mailing Address:

City:

State:

Zip Code:

Disposal Facility Name:

County of Disposal Facility

Section I: Disposal by Underground Injection - Maximum Annual Tax Limits $25,000.00

Section I

<<<<<

>>>>

<<<<<<<<<<

>>>>>>>>>>>>

1. Enter the total tons of hazardous waste disposed by underground injection during the calendar

quarter (attached Schedule HW-021).

2. Tax Due (multiply Line 1 by the current tax rate - see instructions).

3. Enter the total of all previous hazardous waste tax paid on underground injection for the current

year.

4. Total hazardous waste tax for the calendar year (Line 2 plus Line 3).

A. If Line 3 is greater than or equal to $25,000.00, enter zero (-0-) on Line 5.

B.

If Line 4 is greater than or equal to $25,000.00, but Line 3 is zero (-0-), enter $25,000.00 on

Line 5.

**************************************

C.

If Line 4 is less than $25,000.00, enter the figure from Line 2 on Line 5.

Read Instructions before entering

D. If Line 2 is less than $25,000.00, but Line 4 is greater than $25,000.00, enter the difference

an amount on Line 5.

of $25,000.00 minus Line 3 on Line 5.

**************************************

5. Net tax due on underground injection for the current calendar quarter.

<<<<<

Section II: Disposal by Other Methods - Hazardous Waste Generated in Indiana

>>>>>

Section II

<<<<<<<<<<

>>>>>>>>>>>

6. Enter the total tons of hazardous waste generated in and disposed of in Indiana (attach Schedule

HW-021).

7. Tax Due (multiply Line 6 by the current tax rate - see instructions).

Section III: Disposal by Other Methods - Hazardous Waste Generated Outside of Indiana

Section III

<<

<<<<<<<<<<

>>>>>>>>>>>

>

8. Enter the total tons of hazardous waste generated outside of Indiana and subsequently disposed

of in Indiana (attach Schedule HW-021).

9. Tax due (multiply Line 8 by the out of state tax rate of the state in which the hazardous waste

was generated or the current Indiana tax rate, Whichever is Greater - see instructions).

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Section IV: Amount Due

>>>>>>>>>>>>>>>>>>>>>>>>>>>>

<<<<<<<<<<

Section IV

>>>>>>>>>>>

10. Total tax due (enter the total of Line 5, 7 and 9).

11. Penalty (10% of Line 10, if filed after the due date).

12. Interest (if filed after the due date, see instructions).

13. Total amount due (enter the total of Line 10, 11 and 12).

I hereby declare under the penalty of perjury that the information contained in this return, including accompanying schedules and

statements, is true, correct and complete to the best of my knowledge and belief.

Signature of Taxpayer or Duly Authorized Agent

Print or Type Name

Title

Telephone Number

Date

Make Check Payable to: Indiana Department of Revenue and mail the completed return and check to:

Indiana Department of Revenue, Fuel & Environmental Section, 100 N. Senate Ave.

Indianapolis, Indiana 46204-2253

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2