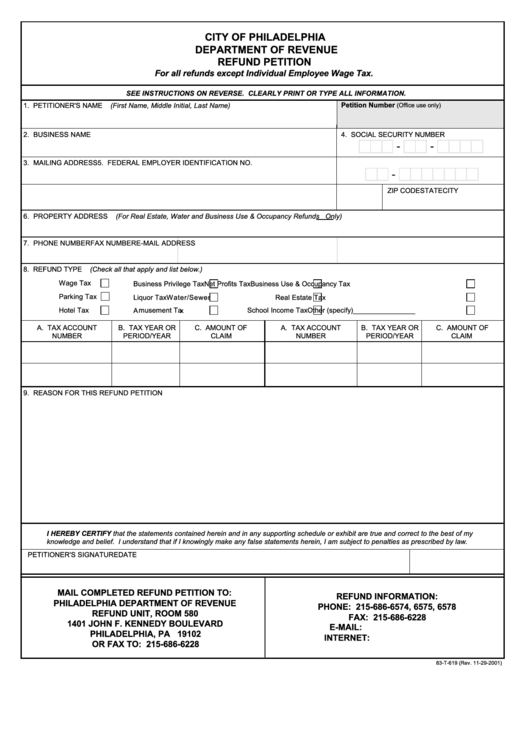

Form 83-T-619 - Refund Petition

ADVERTISEMENT

CITY OF PHILADELPHIA

DEPARTMENT OF REVENUE

REFUND PETITION

For all refunds except Individual Employee Wage Tax.

SEE INSTRUCTIONS ON REVERSE. CLEARLY PRINT OR TYPE ALL INFORMATION.

Petition Number

1. PETITIONER'S NAME (First Name, Middle Initial, Last Name)

(Office use only)

2. BUSINESS NAME

4. SOCIAL SECURITY NUMBER

-

-

5. FEDERAL EMPLOYER IDENTIFICATION NO.

3. MAILING ADDRESS

-

CITY

STATE

ZIP CODE

6. PROPERTY ADDRESS (For Real Estate, Water and Business Use & Occupancy Refunds Only)

7. PHONE NUMBER

FAX NUMBER

E-MAIL ADDRESS

8. REFUND TYPE (Check all that apply and list below.)

Wage Tax

Business Privilege Tax

Net Profits Tax

Business Use & Occupancy Tax

Parking Tax

Liquor Tax

Water/Sewer

Real Estate Tax

Hotel Tax

Amusement Tax

School Income Tax

Other (specify)________________

A. TAX ACCOUNT

B. TAX YEAR OR

C. AMOUNT OF

A. TAX ACCOUNT

B. TAX YEAR OR

C. AMOUNT OF

NUMBER

PERIOD/YEAR

CLAIM

NUMBER

PERIOD/YEAR

CLAIM

9. REASON FOR THIS REFUND PETITION

I HEREBY CERTIFY that the statements contained herein and in any supporting schedule or exhibit are true and correct to the best of my

knowledge and belief. I understand that if I knowingly make any false statements herein, I am subject to penalties as prescribed by law.

PETITIONER'S SIGNATURE

DATE

MAIL COMPLETED REFUND PETITION TO:

REFUND INFORMATION:

PHILADELPHIA DEPARTMENT OF REVENUE

PHONE: 215-686-6574, 6575, 6578

REFUND UNIT, ROOM 580

FAX: 215-686-6228

1401 JOHN F. KENNEDY BOULEVARD

E-MAIL: revenue@phila.gov

PHILADELPHIA, PA 19102

INTERNET: phila.gov/revenue

OR FAX TO: 215-686-6228

83-T-619 (Rev. 11-29-2001)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1