Form Np-20a - State Form 51064 - Nonprofit Application For Sales Tax Exemption

ADVERTISEMENT

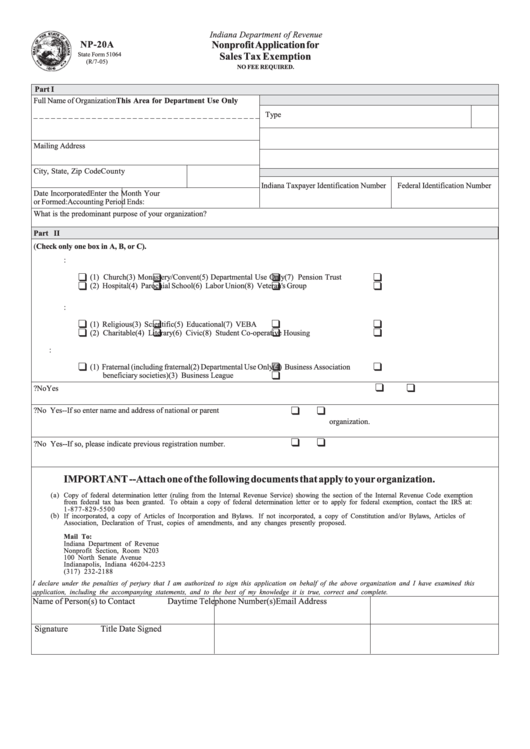

Indiana Department of Revenue

NP-20A

Nonprofit Application for

Sales Tax Exemption

State Form 51064

(R/7-05)

NO FEE REQUIRED.

Part I

Full Name of Organization

This Area for Department Use Only

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Type

Mailing Address

City, State, Zip Code

County

Indiana Taxpayer Identification Number

Federal Identification Number

Date Incorporated

Enter the Month Your

or Formed:

Accounting Period Ends:

What is the predominant purpose of your organization?

Part II

1.

Indicate type of qualifying organization named in I.C. 6-2.5-5-21 (Check only one box in A, B, or C).

A. Organized specifically as a:

(1) Church

(3) Monastery/Convent

(5) Departmental Use Only

(7) Pension Trust

(2) Hospital

(4) Parochial School

(6) Labor Union

(8) Veteran's Group

B.

Organized and operated for one of the following reasons:

(1) Religious

(3) Scientific

(5) Educational

(7) VEBA

(2) Charitable

(4) Literary

(6) Civic

(8) Student Co-operative Housing

C.

Organized and operated as one of the following entities:

(1) Fraternal (including fraternal

(2) Departmental Use Only

(4) Business Association

beneficiary societies)

(3) Business League

2.

Does your organization sell or rent personal property for more than 30 days in a calendar year?

No

Yes

3.

Is this organization a local affiliate of a national or parent organization?

No

Yes--If so enter name and address of national or parent

organization.

4.

Has this organization previously applied for Indiana exempt status?

No

Yes--If so, please indicate previous registration number.

IMPORTANT --Attach one of the following documents that apply to your organization.

(a)

Copy of federal determination letter (ruling from the Internal Revenue Service) showing the section of the Internal Revenue Code exemption

from federal tax has been granted. To obtain a copy of federal determination letter or to apply for federal exemption, contact the IRS at:

1-877-829-5500

(b)

If incorporated, a copy of Articles of Incorporation and Bylaws. If not incorporated, a copy of Constitution and/or Bylaws, Articles of

Association, Declaration of Trust, copies of amendments, and any changes presently proposed.

Mail To:

Indiana Department of Revenue

Nonprofit Section, Room N203

100 North Senate Avenue

Indianapolis, Indiana 46204-2253

(317) 232-2188

I declare under the penalties of perjury that I am authorized to sign this application on behalf of the above organization and I have examined this

application, including the accompanying statements, and to the best of my knowledge it is true, correct and complete.

Name of Person(s) to Contact

Daytime Telephone Number(s)

Email Address

Signature

Title

Date Signed

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1