Form Otc - General Instructions

ADVERTISEMENT

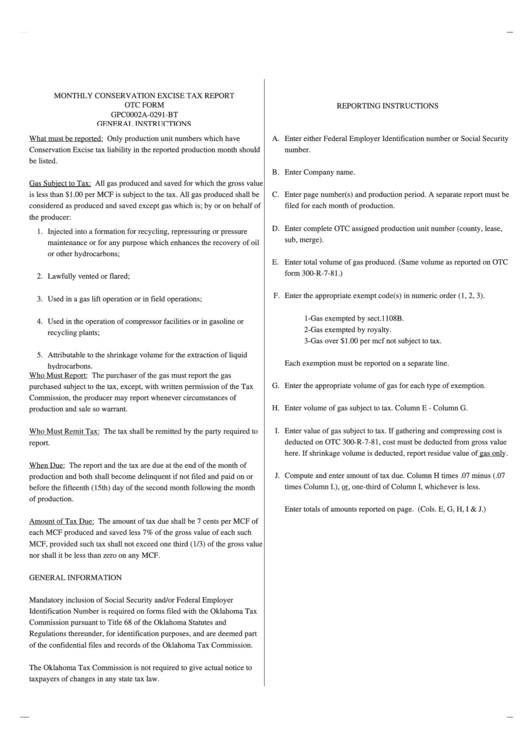

MONTHLY CONSERVATION EXCISE TAX REPORT

OTC FORM

REPORTING INSTRUCTIONS

GPC0002A-0291-BT

GENERAL INSTRUCTIONS

What must be reported: Only production unit numbers which have

A.

Enter either Federal Employer Identification number or Social Security

Conservation Excise tax liability in the reported production month should

number.

be listed.

B.

Enter Company name.

Gas Subject to Tax: All gas produced and saved for which the gross value

is less than $1.00 per MCF is subject to the tax. All gas produced shall be

C.

Enter page number(s) and production period. A separate report must be

considered as produced and saved except gas which is; by or on behalf of

filed for each month of production.

the producer:

D.

Enter complete OTC assigned production unit number (county, lease,

1.

Injected into a formation for recycling, repressuring or pressure

sub, merge).

maintenance or for any purpose which enhances the recovery of oil

or other hydrocarbons;

E.

Enter total volume of gas produced. (Same volume as reported on OTC

form 300-R-7-81.)

2.

Lawfully vented or flared;

F.

Enter the appropriate exempt code(s) in numeric order (1, 2, 3).

3.

Used in a gas lift operation or in field operations;

1-Gas exempted by sect.1108B.

4.

Used in the operation of compressor facilities or in gasoline or

2-Gas exempted by royalty.

recycling plants;

3-Gas over $1.00 per mcf not subject to tax.

5.

Attributable to the shrinkage volume for the extraction of liquid

Each exemption must be reported on a separate line.

hydrocarbons.

Who Must Report: The purchaser of the gas must report the gas

G.

Enter the appropriate volume of gas for each type of exemption.

purchased subject to the tax, except, with written permission of the Tax

Commission, the producer may report whenever circumstances of

H.

Enter volume of gas subject to tax. Column E - Column G.

production and sale so warrant.

I.

Enter value of gas subject to tax. If gathering and compressing cost is

Who Must Remit Tax: The tax shall be remitted by the party required to

deducted on OTC 300-R-7-81, cost must be deducted from gross value

report.

here. If shrinkage volume is deducted, report residue value of gas only.

When Due: The report and the tax are due at the end of the month of

J.

Compute and enter amount of tax due. Column H times .07 minus (.07

production and both shall become delinquent if not filed and paid on or

times Column I.), or, one-third of Column I, whichever is less.

before the fifteenth (15th) day of the second month following the month

of production.

Enter totals of amounts reported on page. (Cols. E, G, H, I & J.)

Amount of Tax Due: The amount of tax due shall be 7 cents per MCF of

each MCF produced and saved less 7% of the gross value of each such

MCF, provided such tax shall not exceed one third (1/3) of the gross value

nor shall it be less than zero on any MCF.

GENERAL INFORMATION

Mandatory inclusion of Social Security and/or Federal Employer

Identification Number is required on forms filed with the Oklahoma Tax

Commission pursuant to Title 68 of the Oklahoma Statutes and

Regulations thereunder, for identification purposes, and are deemed part

of the confidential files and records of the Oklahoma Tax Commission.

The Oklahoma Tax Commission is not required to give actual notice to

taxpayers of changes in any state tax law.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1