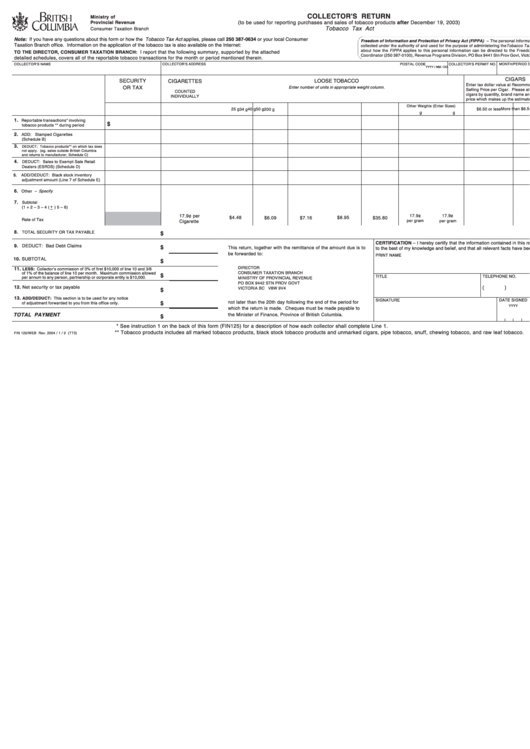

Form Tt3 - Collector'S Return

Download a blank fillable Form Tt3 - Collector'S Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Tt3 - Collector'S Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

COLLECTOR'S RETURN

Ministry of

TT3

Provincial Revenue

(to be used for reporting purchases and sales of tobacco products after December 19, 2003)

Tobacco Tax Act

Consumer Taxation Branch

Note: If you have any questions about this form or how the Tobacco Tax Act applies, please call 250 387-0634 or your local Consumer

Freedom of Information and Protection of Privacy Act (FIPPA) – The personal information requested is

Taxation Branch office. Information on the application of the tobacco tax is also available on the Internet:

collected under the authority of and used for the purpose of administering the Tobacco Tax Act . Questions

about how the FIPPA applies to this personal information can be directed to the Freedom of Information

TO THE DIRECTOR, CONSUMER TAXATION BRANCH:

I report that the following summary, supported by the attached

Coordinator (250 387-0100), Revenue Programs Division, PO Box 9441 Stn Prov Govt, Victoria BC V8W 9V4.

detailed schedules, covers all of the reportable tobacco transactions for the month or period mentioned therein.

COLLECTOR'S NAME

COLLECTOR'S ADDRESS

POSTAL CODE

COLLECTOR'S PERMIT NO.

MONTH/PERIOD END DATE

YYYY / MM / DD

CIGARS

SECURITY

CIGARETTES

LOOSE TOBACCO

Enter tax dollar value at Recommended Retail

OR TAX

Enter number of units in appropriate weight column.

Selling Price per Cigar. Please attach a list of the

COUNTED

cigars by quantity, brand name and suggested retail

INDIVIDUALLY

price which makes up the estimated security or tax.

Other Weights (Enter Sizes)

25 g

40 g

50 g

200 g

$6.50 or less

More than $6.50

34 g

g

g

1.

Reportable transactions* involving

$

tobacco products ** during period

2.

ADD: Stamped Cigarettes

(Schedule B)

3.

DEDUCT: Tobacco products** on which tax does

not apply. (eg. sales outside British Columbia

and returns to manufacturer, Schedule C)

4.

DEDUCT: Sales to Exempt Sale Retail

Dealers (ESRDS) (Schedule D)

5.

ADD/DEDUCT: Black stock inventory

adjustment amount (Line 7 of Schedule E)

6.

Other – Specify

7.

Subtotal

+

(1 + 2 – 3 – 4 (

) 5 – 6)

–

17.9¢ per

17.9¢

17.9¢

$4.48

$6.09

$7.16

$8.95

$35.80

Rate of Tax

per gram

Cigarette

per gram

8.

TOTAL SECURITY OR TAX PAYABLE

$

CERTIFICATION – I hereby certify that the information contained in this return is correct

9. DEDUCT: Bad Debt Claims

$

This return, together with the remittance of the amount due is to

to the best of my knowledge and belief, and that all relevant facts have been revealed.

be forwarded to:

PRINT NAME

10. SUBTOTAL

$

DIRECTOR

11.

LESS: Collector's commission of 3% of first $10,000 of line 10 and 3/8

CONSUMER TAXATION BRANCH

of 1% of the balance of line 10 per month. Maximum commission allowed

$

TELEPHONE NO.

TITLE

per annum to any person, partnership or corporate entity is $10,000.

MINISTRY OF PROVINCIAL REVENUE

PO BOX 9442 STN PROV GOVT

12. Net security or tax payable

(

)

VICTORIA BC V8W 9V4

$

13.

ADD/DEDUCT: This section is to be used for any notice

SIGNATURE

DATE SIGNED

not later than the 20th day following the end of the period for

$

of adjustment forwarded to you from this office only.

YYYY

MM

DD

which the return is made. Cheques must be made payable to

TOTAL PAYMENT

the Minister of Finance, Province of British Columbia.

$

* See instruction 1 on the back of this form (FIN125) for a description of how each collector shall complete Line 1.

** Tobacco products includes all marked tobacco products, black stock tobacco products and unmarked cigars, pipe tobacco, snuff, chewing tobacco, and raw leaf tobacco.

FIN 125/WEB Rev. 2004 / 1 / 2 (TT3)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7