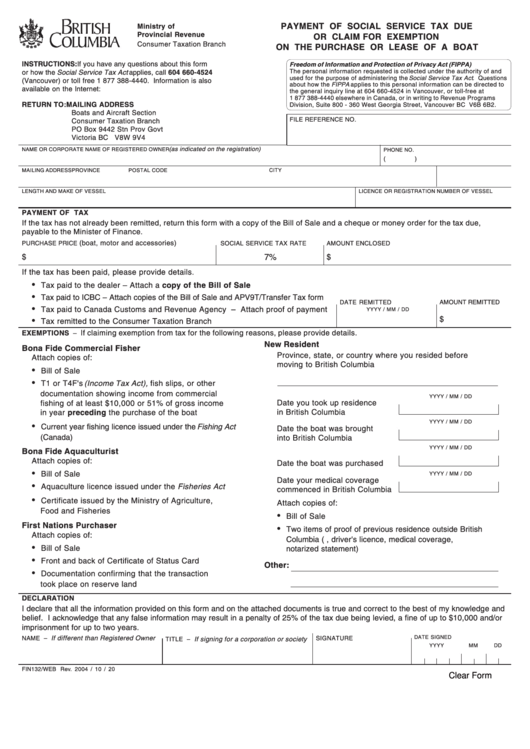

PAYMENT OF SOCIAL SERVICE TAX DUE

Ministry of

Provincial Revenue

OR CLAIM FOR EXEMPTION

Consumer Taxation Branch

ON THE PURCHASE OR LEASE OF A BOAT

INSTRUCTIONS: If you have any questions about this form

Freedom of Information and Protection of Privacy Act (FIPPA)

The personal information requested is collected under the authority of and

or how the Social Service Tax Act applies, call 604 660-4524

used for the purpose of administering the Social Service Tax Act . Questions

(Vancouver) or toll free 1 877 388-4440. Information is also

about how the FIPPA applies to this personal information can be directed to

available on the Internet:

the general inquiry line at 604 660-4524 in Vancouver, or toll-free at

1 877 388-4440 elsewhere in Canada, or in writing to Revenue Programs

RETURN TO: MAILING ADDRESS

Division, Suite 800 - 360 West Georgia Street, Vancouver BC V6B 6B2.

Boats and Aircraft Section

FILE REFERENCE NO.

Consumer Taxation Branch

PO Box 9442 Stn Prov Govt

Victoria BC V8W 9V4

(as indicated on the registration)

NAME OR CORPORATE NAME OF REGISTERED OWNER

PHONE NO.

(

)

CITY

MAILING ADDRESS

PROVINCE

POSTAL CODE

LICENCE OR REGISTRATION NUMBER OF VESSEL

LENGTH AND MAKE OF VESSEL

PAYMENT OF TAX

If the tax has not already been remitted, return this form with a copy of the Bill of Sale and a cheque or money order for the tax due,

payable to the Minister of Finance.

(boat, motor and accessories)

PURCHASE PRICE

SOCIAL SERVICE TAX RATE

AMOUNT ENCLOSED

7%

$

$

If the tax has been paid, please provide details.

•

Tax paid to the dealer – Attach a copy of the Bill of Sale

•

Tax paid to ICBC – Attach copies of the Bill of Sale and APV9T/Transfer Tax form

DATE REMITTED

AMOUNT REMITTED

•

Tax paid to Canada Customs and Revenue Agency – Attach proof of payment

YYYY / MM / DD

$

•

Tax remitted to the Consumer Taxation Branch

If claiming exemption from tax for the following reasons, please provide details.

EXEMPTIONS

–

New Resident

Bona Fide Commercial Fisher

Province, state, or country where you resided before

Attach copies of:

moving to British Columbia

•

Bill of Sale

•

T1 or T4F's (Income Tax Act), fish slips, or other

documentation showing income from commercial

YYYY / MM / DD

fishing of at least $10,000 or 51% of gross income

Date you took up residence

in British Columbia

in year preceding the purchase of the boat

YYYY / MM / DD

•

Current year fishing licence issued under the Fishing Act

Date the boat was brought

(Canada)

into British Columbia

YYYY / MM / DD

Bona Fide Aquaculturist

Attach copies of:

Date the boat was purchased

•

Bill of Sale

YYYY / MM / DD

Date your medical coverage

•

Aquaculture licence issued under the Fisheries Act

commenced in British Columbia

•

Certificate issued by the Ministry of Agriculture,

Attach copies of:

Food and Fisheries

•

Bill of Sale

First Nations Purchaser

•

Two items of proof of previous residence outside British

Attach copies of:

Columbia (e.g., driver's licence, medical coverage,

•

Bill of Sale

notarized statement)

•

Front and back of Certificate of Status Card

Other:

•

Documentation confirming that the transaction

took place on reserve land

DECLARATION

I declare that all the information provided on this form and on the attached documents is true and correct to the best of my knowledge and

belief. I acknowledge that any false information may result in a penalty of 25% of the tax due being levied, a fine of up to $10,000 and/or

imprisonment for up to two years.

DATE SIGNED

NAME –

If different than Registered Owner

SIGNATURE

TITLE –

If signing for a corporation or society

YYYY

MM

DD

FIN 132/WEB Rev. 2004 / 10 / 20

Clear Form

1

1