Reset Form

Print Form

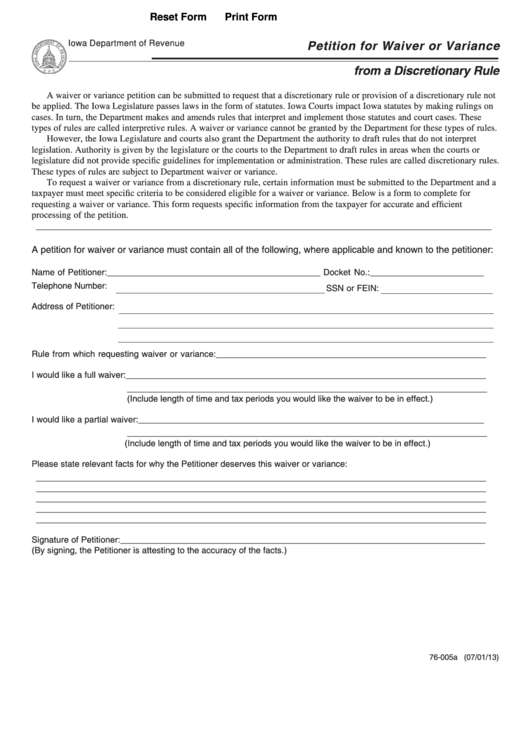

Petition for Waiver or Variance

Iowa Department of Revenue

from a Discretionary Rule

A waiver or variance petition can be submitted to request that a discretionary rule or provision of a discretionary rule not

be applied. The Iowa Legislature passes laws in the form of statutes. Iowa Courts impact Iowa statutes by making rulings on

cases. In turn, the Department makes and amends rules that interpret and implement those statutes and court cases. These

types of rules are called interpretive rules. A waiver or variance cannot be granted by the Department for these types of rules.

However, the Iowa Legislature and courts also grant the Department the authority to draft rules that do not interpret

legislation. Authority is given by the legislature or the courts to the Department to draft rules in areas when the courts or

legislature did not provide specific guidelines for implementation or administration. These rules are called discretionary rules.

These types of rules are subject to Department waiver or variance.

To request a waiver or variance from a discretionary rule, certain information must be submitted to the Department and a

taxpayer must meet specific criteria to be considered eligible for a waiver or variance. Below is a form to complete for

requesting a waiver or variance. This form requests specific information from the taxpayer for accurate and efficient

processing of the petition.

________________________________________________________________________________________________

A petition for waiver or variance must contain all of the following, where applicable and known to the petitioner:

Name of Petitioner: _____________________________________________ Docket No.: ________________________

Telephone Number:

SSN or FEIN:

Address of Petitioner:

Rule from which requesting waiver or variance: _________________________________________________________

I would like a full waiver: ____________________________________________________________________________

____________________________________________________________________________

(Include length of time and tax periods you would like the waiver to be in effect.)

I would like a partial waiver: _________________________________________________________________________

____________________________________________________________________________

(Include length of time and tax periods you would like the waiver to be in effect.)

Please state relevant facts for why the Petitioner deserves this waiver or variance:

_______________________________________________________________________________________________

_______________________________________________________________________________________________

_______________________________________________________________________________________________

_______________________________________________________________________________________________

_______________________________________________________________________________________________

Signature of Petitioner: _____________________________________________________________________________

(By signing, the Petitioner is attesting to the accuracy of the facts.)

76-005a (07/01/13)

1

1 2

2