Form 70-108-04-1-1-000 - Tax Amnesty Application 2004

ADVERTISEMENT

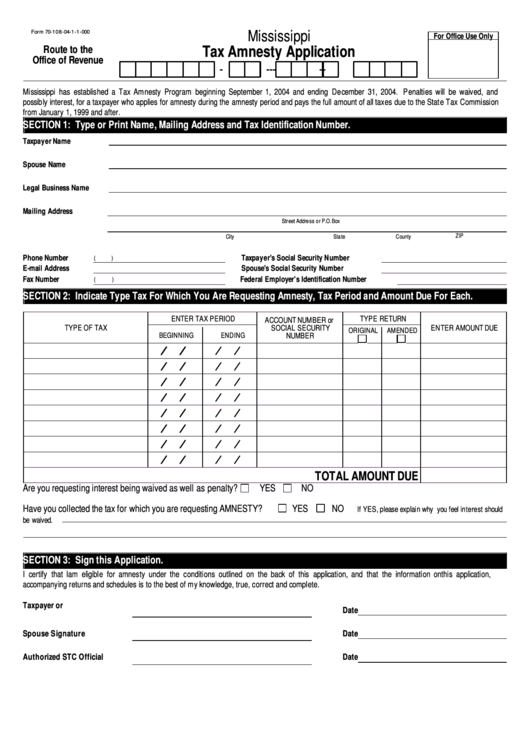

Mississippi

Form 70-108-04-1-1-000

For Office Use Only

Tax Amnesty Application

Route to the

Office of Revenue

-

-

-

-

-

-

Mississippi has established a Tax Amnesty Program beginning September 1, 2004 and ending December 31, 2004. Penalties will be waived, and

possibly interest, for a taxpayer who applies for amnesty during the amnesty period and pays the full amount of all taxes due to the State Tax Commission

from January 1, 1999 and after.

SECTION 1: Type or Print Name, Mailing Address and Tax Identification Number.

Taxpayer Name

Spouse Name

Legal Business Name

Mailing Address

Street Address or P.O. Box

ZIP

City

State

County

Phone Number

Taxpayer's Social Security Number

(

)

E-mail Address

Spouse's Social Security Number

Fax Number

Federal Employer's Identification Number

(

)

SECTION 2: Indicate Type Tax For Which You Are Requesting Amnesty, Tax Period and Amount Due For Each.

ENTER TAX PERIOD

TYPE RETURN

ACCOUNT NUMBER or

TYPE OF TAX

SOCIAL SECURITY

ENTER AMOUNT DUE

ORIGINAL

AMENDED

BEGINNING

ENDING

NUMBER

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

TOTAL AMOUNT DUE

Are you requesting interest being waived as well as penalty?

YES

NO

Have you collected the tax for which you are requesting AMNESTY?

YES

NO

If YES, please explain why you feel interest should

be waived.

SECTION 3: Sign this Application.

I certify that I am eligible for amnesty under the conditions outlined on the back of this application, and that the information on this application,

accompanying returns and schedules is to the best of my knowledge, true, correct and complete.

Taxpayer or

Date

Spouse Signature

Date

Authorized STC Official

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1