Form 656-A - Income Certification For Offer In Compromise Application Fee And Payment Form - Internal Revenue Service

ADVERTISEMENT

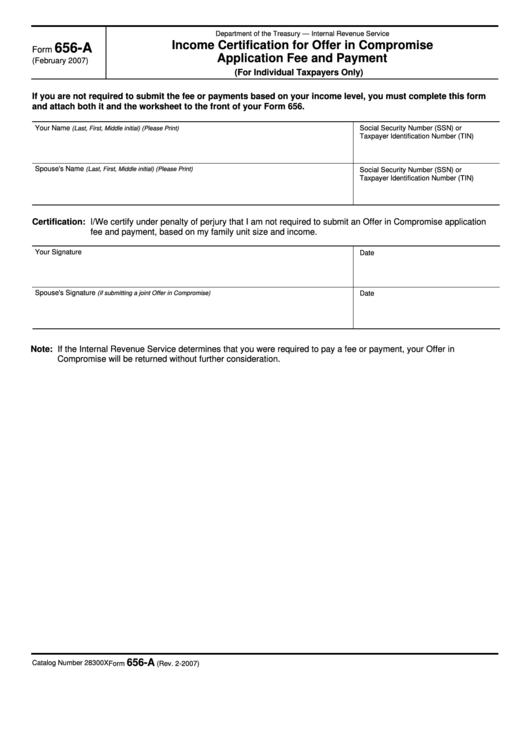

Department of the Treasury — Internal Revenue Service

Income Certification for Offer in Compromise

656-A

Form

Application Fee and Payment

(February 2007)

(For Individual Taxpayers Only)

If you are not required to submit the fee or payments based on your income level, you must complete this form

and attach both it and the worksheet to the front of your Form 656.

Your Name

Social Security Number (SSN) or

(Last, First, Middle initial) (Please Print)

Taxpayer Identification Number (TIN)

Spouse's Name

(Last, First, Middle initial) (Please Print)

Social Security Number (SSN) or

Taxpayer Identification Number (TIN)

Certification: I/We certify under penalty of perjury that I am not required to submit an Offer in Compromise application

fee and payment, based on my family unit size and income.

Your Signature

Date

Spouse's Signature

(if submitting a joint Offer in Compromise)

Date

Note: If the Internal Revenue Service determines that you were required to pay a fee or payment, your Offer in

Compromise will be returned without further consideration.

656-A

Catalog Number 28300X

Form

(Rev. 2-2007)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1