Form Rpd-41303 - Application For New Mexico Filmmaker Tax Credit

ADVERTISEMENT

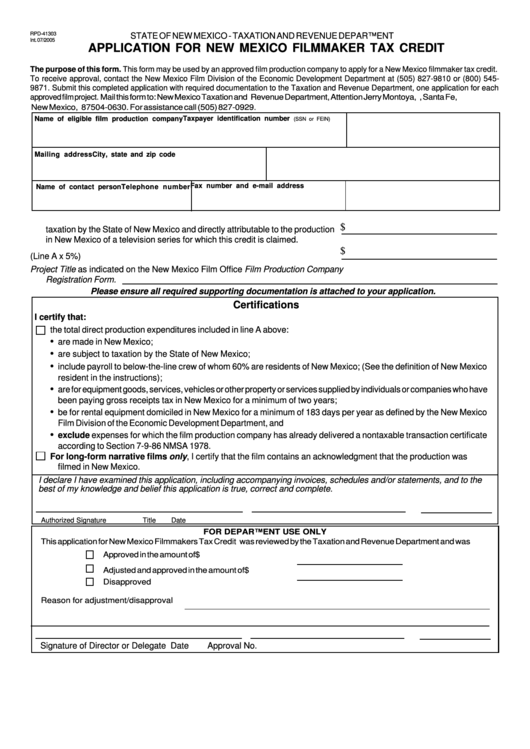

RPD-41303

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

Int. 07/2005

APPLICATION FOR NEW MEXICO FILMMAKER TAX CREDIT

The purpose of this form. This form may be used by an approved film production company to apply for a New Mexico filmmaker tax credit.

To receive approval, contact the New Mexico Film Division of the Economic Development Department at (505) 827-9810 or (800) 545-

9871. Submit this completed application with required documentation to the Taxation and Revenue Department, one application for each

approved film project. Mail this form to: New Mexico Taxation and Revenue Department, Attention Jerry Montoya, P.O. Box 630, Santa Fe,

New Mexico, 87504-0630. For assistance call (505) 827-0929.

Taxpayer identification number

Name of eligible film production company

(SSN or FEIN)

Mailing address

City, state and zip code

Fax number and e-mail address

Name of contact person

Telephone number

A. Total direct production expenditures made in New Mexico that are subject to

$

taxation by the State of New Mexico and directly attributable to the production

in New Mexico of a television series for which this credit is claimed.

$

B. New Mexico filmmakers production tax credit claimed (Line A x 5%)

C. Enter the Project Title as indicated on the New Mexico Film Office Film Production Company

Registration Form.

Please ensure all required supporting documentation is attached to your application.

Certifications

I certify that:

the total direct production expenditures included in line A above:

•

are made in New Mexico;

•

are subject to taxation by the State of New Mexico;

•

include payroll to below-the-line crew of whom 60% are residents of New Mexico; (See the definition of New Mexico

resident in the instructions);

•

are for equipment goods, services, vehicles or other property or services supplied by individuals or companies who have

been paying gross receipts tax in New Mexico for a minimum of two years;

•

be for rental equipment domiciled in New Mexico for a minimum of 183 days per year as defined by the New Mexico

Film Division of the Economic Development Department, and

•

exclude expenses for which the film production company has already delivered a nontaxable transaction certificate

according to Section 7-9-86 NMSA 1978.

For long-form narrative films only, I certify that the film contains an acknowledgment that the production was

filmed in New Mexico.

I declare I have examined this application, including accompanying invoices, schedules and/or statements, and to the

best of my knowledge and belief this application is true, correct and complete.

Authorized Signature

Title

Date

FOR DEPARTMENT USE ONLY

This application for New Mexico Filmmakers Tax Credit was reviewed by the Taxation and Revenue Department and was

Approved in the amount of

$

Adjusted and approved in the amount of

$

Disapproved

Reason for adjustment/disapproval

Signature of Director or Delegate

Date

Approval No.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2