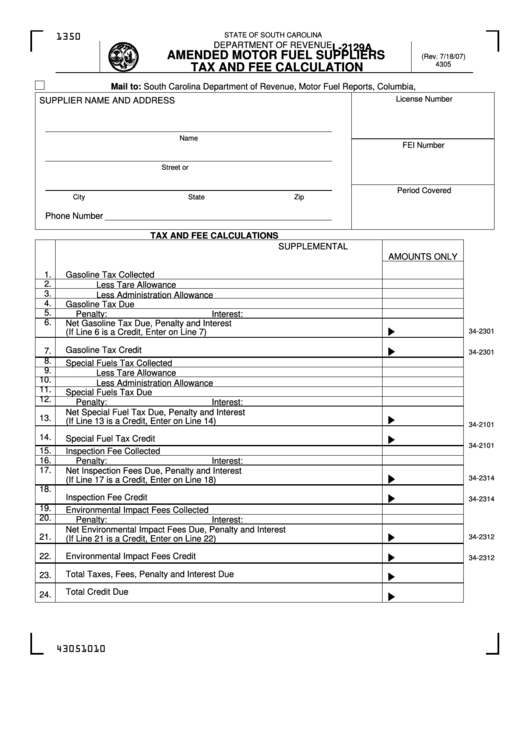

Form L-2129a - Amended Motor Fuel Suppliers Tax And Fee Calculation

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

DEPARTMENT OF REVENUE

L-2129A

AMENDED MOTOR FUEL SUPPLIERS

(Rev. 7/18/07)

4305

TAX AND FEE CALCULATION

EFT

Mail to: South Carolina Department of Revenue, Motor Fuel Reports, Columbia, SC 29214-0132.

License Number

SUPPLIER NAME AND ADDRESS

Name

FEI Number

Street or P.O. Box

Period Covered

City

State

Zip

Phone Number

TAX AND FEE CALCULATIONS

SUPPLEMENTAL

AMOUNTS ONLY

1.

Gasoline Tax Collected

2.

Less Tare Allowance

3.

Less Administration Allowance

4.

Gasoline Tax Due

5.

Penalty:

Interest:

6.

Net Gasoline Tax Due, Penalty and Interest

34-2301

(If Line 6 is a Credit, Enter on Line 7)

Gasoline Tax Credit

7.

34-2301

8.

Special Fuels Tax Collected

9.

Less Tare Allowance

10.

Less Administration Allowance

11.

Special Fuels Tax Due

12.

Penalty:

Interest:

Net Special Fuel Tax Due, Penalty and Interest

13.

(If Line 13 is a Credit, Enter on Line 14)

34-2101

14.

Special Fuel Tax Credit

34-2101

15.

Inspection Fee Collected

16.

Penalty:

Interest:

17.

Net Inspection Fees Due, Penalty and Interest

34-2314

(If Line 17 is a Credit, Enter on Line 18)

18.

Inspection Fee Credit

34-2314

19.

Environmental Impact Fees Collected

20.

Penalty:

Interest:

Net Environmental Impact Fees Due, Penalty and Interest

21.

34-2312

(If Line 21 is a Credit, Enter on Line 22)

22.

Environmental Impact Fees Credit

34-2312

Total Taxes, Fees, Penalty and Interest Due

23.

Total Credit Due

24.

43051010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2