Form Wv/mft-514 - West Virginia Producer Report

ADVERTISEMENT

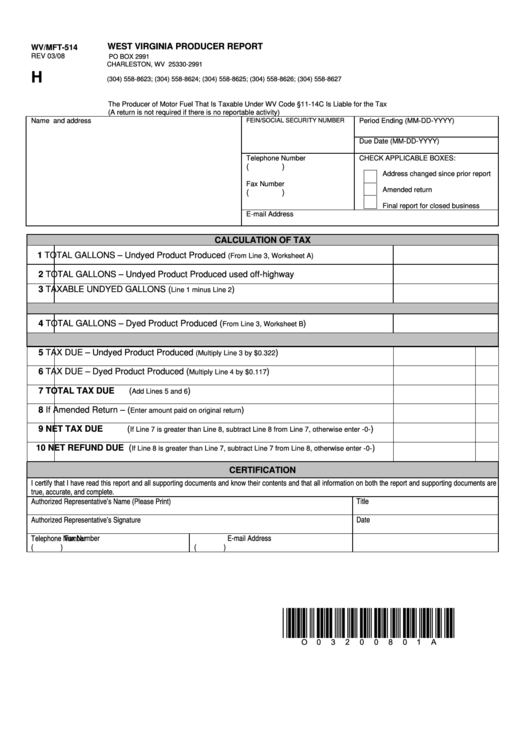

WV/MFT-514

WEST VIRGINIA PRODUCER REPORT

REV 03/08

PO BOX 2991

CHARLESTON, WV 25330-2991

H

(304) 558-8623; (304) 558-8624; (304) 558-8625; (304) 558-8626; (304) 558-8627

The Producer of Motor Fuel That Is Taxable Under WV Code §11-14C Is Liable for the Tax

(A return is not required if there is no reportable activity)

Name and address

FEIN/SOCIAL SECURITY NUMBER

Period Ending (MM-DD-YYYY)

Due Date (MM-DD-YYYY)

Telephone Number

CHECK APPLICABLE BOXES:

(

)

Address changed since prior report

Fax Number

Amended return

(

)

Final report for closed business

E-mail Address

CALCULATION OF TAX

1

TOTAL GALLONS – Undyed Product Produced

(From Line 3, Worksheet A)

TOTAL GALLONS – Undyed Product Produced used off-highway

2

3

TAXABLE UNDYED GALLONS (

)

Line 1 minus Line 2

4

TOTAL GALLONS – Dyed Product Produced (

)

From Line 3, Worksheet B

5

TAX DUE – Undyed Product Produced

)

(Multiply Line 3 by $0.322

6

TAX DUE – Dyed Product Produced (

)

Multiply Line 4 by $0.117

7

TOTAL TAX DUE

(

)

Add Lines 5 and 6

If Amended Return – (

)

8

Enter amount paid on original return

9

NET TAX DUE

(

)

If Line 7 is greater than Line 8, subtract Line 8 from Line 7, otherwise enter -0-

10

NET REFUND DUE (

)

If Line 8 is greater than Line 7, subtract Line 7 from Line 8, otherwise enter -0-

CERTIFICATION

I certify that I have read this report and all supporting documents and know their contents and that all information on both the report and supporting documents are

true, accurate, and complete.

Authorized Representative’s Name (Please Print)

Title

Authorized Representative’s Signature

Date

Telephone Number

Fax Number

E-mail Address

(

)

(

)

*O03200801A*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2