Instructions For The W-2 Transmittal (Rev-1667r) Form

ADVERTISEMENT

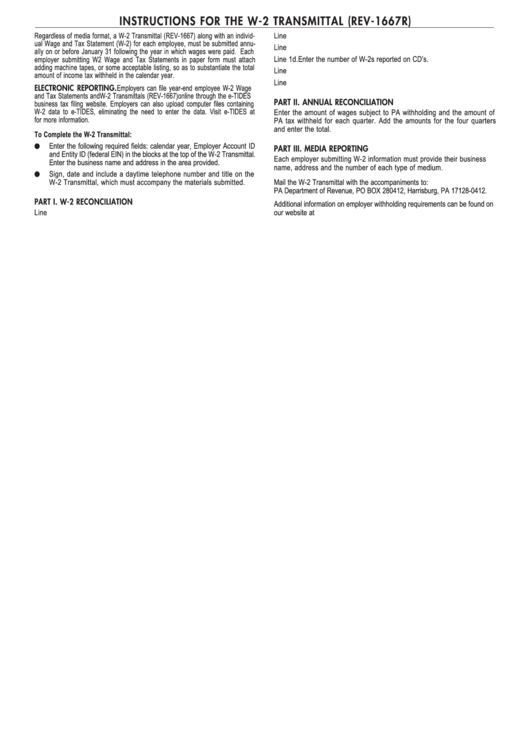

INSTRUCTIONS FOR THE W-2 TRANSMITTAL (REV-1667R)

Regardless of media format, a W-2 Transmittal (REV-1667) along with an individ-

Line 1b. Enter the number of 1099 forms with PA withholding tax.

ual Wage and Tax Statement (W-2) for each employee, must be submitted annu-

Line 1c. Enter the number of W-2s reported on magnetic tapes.

ally on or before January 31 following the year in which wages were paid. Each

employer submitting W2 Wage and Tax Statements in paper form must attach

Line 1d. Enter the number of W-2s reported on CD’s.

adding machine tapes, or some acceptable listing, so as to substantiate the total

Line 2.

Enter the total compensation subject to PA withholding.

amount of income tax withheld in the calendar year.

Line 3.

Enter the total amount of PA personal income tax withheld.

ELECTRONIC REPORTING. Employers can file year-end employee W-2 Wage

and Tax Statements and W-2 Transmittals (REV-1667) online through the e-TIDES

PART II. ANNUAL RECONCILIATION

business tax filing website. Employers can also upload computer files containing

W-2 data to e-TIDES, eliminating the need to enter the data. Visit e-TIDES at

Enter the amount of wages subject to PA withholding and the amount of

for more information.

PA tax withheld for each quarter. Add the amounts for the four quarters

and enter the total.

To Complete the W-2 Transmittal:

●

Enter the following required fields: calendar year, Employer Account ID

PART III. MEDIA REPORTING

and Entity ID (federal EIN) in the blocks at the top of the W-2 Transmittal.

Each employer submitting W-2 information must provide their business

Enter the business name and address in the area provided.

name, address and the number of each type of medium.

●

Sign, date and include a daytime telephone number and title on the

W-2 Transmittal, which must accompany the materials submitted.

Mail the W-2 Transmittal with the accompaniments to:

PA Department of Revenue, PO BOX 280412, Harrisburg, PA 17128-0412.

PART I. W-2 RECONCILIATION

Additional information on employer withholding requirements can be found on

Line 1a. Enter the number of W-2 forms attached.

our website at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1