Form St-131 - Seller'S Report Of Sales Tax Due On A Casual Sale

ADVERTISEMENT

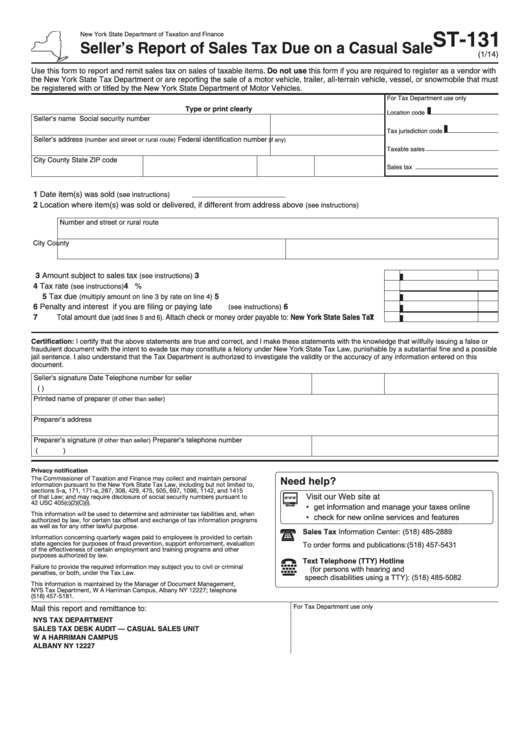

ST-131

New York State Department of Taxation and Finance

Seller’s Report of Sales Tax Due on a Casual Sale

(1/14)

Use this form to report and remit sales tax on sales of taxable items. Do not use this form if you are required to register as a vendor with

the New York State Tax Department or are reporting the sale of a motor vehicle, trailer, all-terrain vehicle, vessel, or snowmobile that must

be registered with or titled by the New York State Department of Motor Vehicles.

For Tax Department use only

Type or print clearly

Location code

Seller’s name

Social security number

Tax jurisdiction code

Seller’s address

Federal identification number

(number and street or rural route)

(if any)

Taxable sales

City

County

State

ZIP code

Sales tax

1

Date item(s) was sold

(see instructions)

2

Location where item(s) was sold or delivered, if different from address above

(see instructions)

Number and street or rural route

City

County

3

Amount subject to sales tax

...............................................................................

3

(see instructions)

4

Tax rate

..............................................................................................................

4

%

(see instructions)

5

5

Tax due

..........................................................................

(multiply amount on line 3 by rate on line 4)

6

6

Penalty and interest if you are filing or paying late

.............................................

(see instructions)

7

Total amount due

Attach check or money order payable to: New York State Sales Tax ....

7

(add lines 5 and 6).

Certification: I certify that the above statements are true and correct, and I make these statements with the knowledge that willfully issuing a false or

fraudulent document with the intent to evade tax may constitute a felony under New York State Tax Law, punishable by a substantial fine and a possible

jail sentence. I also understand that the Tax Department is authorized to investigate the validity or the accuracy of any information entered on this

document.

Seller’s signature

Date

Telephone number for seller

(

)

Printed name of preparer

(if other than seller)

Preparer’s address

Preparer’s signature

Preparer’s telephone number

(if other than seller)

(

)

Privacy notification

Need help?

The Commissioner of Taxation and Finance may collect and maintain personal

information pursuant to the New York State Tax Law, including but not limited to,

sections 5-a, 171, 171-a, 287, 308, 429, 475, 505, 697, 1096, 1142, and 1415

Visit our Web site at

of that Law; and may require disclosure of social security numbers pursuant to

42 USC 405(c)(2)(C)(i).

• get information and manage your taxes online

This information will be used to determine and administer tax liabilities and, when

• check for new online services and features

authorized by law, for certain tax offset and exchange of tax information programs

as well as for any other lawful purpose.

Sales Tax Information Center:

(518) 485-2889

Information concerning quarterly wages paid to employees is provided to certain

state agencies for purposes of fraud prevention, support enforcement, evaluation

To order forms and publications:

(518) 457-5431

of the effectiveness of certain employment and training programs and other

purposes authorized by law.

Text Telephone (TTY) Hotline

Failure to provide the required information may subject you to civil or criminal

(for persons with hearing and

penalties, or both, under the Tax Law.

speech disabilities using a TTY):

(518) 485-5082

This information is maintained by the Manager of Document Management,

NYS Tax Department, W A Harriman Campus, Albany NY 12227; telephone

(518) 457-5181.

For Tax Department use only

Mail this report and remittance to:

NYS TAX DEPARTMENT

SALES TAX DESK AUDIT — CASUAL SALES UNIT

W A HARRIMAN CAMPUS

ALBANY NY 12227

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1