Form W1 1229 - Employer'S Withholding - Monthly Form 2017

ADVERTISEMENT

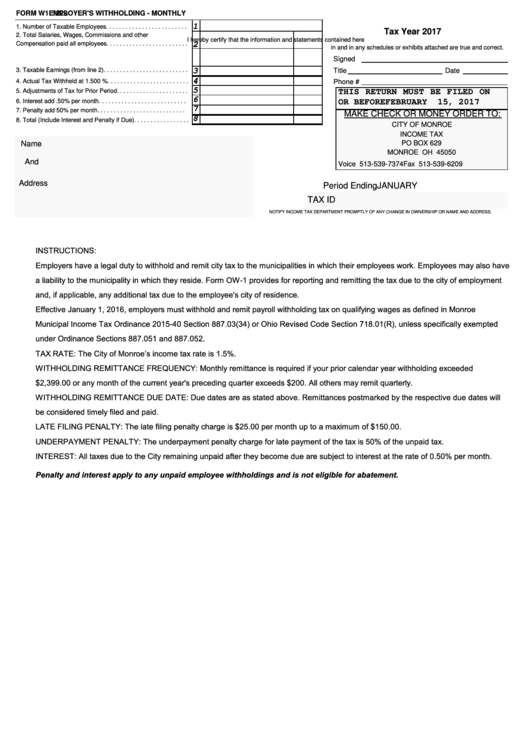

FORM W1

1229

EMPLOYER'S WITHHOLDING - MONTHLY

1

1. Number of Taxable Employees. . . . . . . . . . . . . . . . . . . . . . . . .

Tax Year 2017

2. Total Salaries, Wages, Commissions and other

I hereby certify that the information and statements contained here

Compensation paid all employees. . . . . . . . . . . . . . . . . . . . . . . . .

2

in and in any schedules or exhibits attached are true and correct.

Signed

3. Taxable Earnings (from line 2). . . . . . . . . . . . . . . . . . . . . . . . . .

3

Title

Date

4

4. Actual Tax Withheld at 1.500 %. . . . . . . . . . . . . . . . . . . . . . . . .

Phone #

5

5. Adjustments of Tax for Prior Period. . . . . . . . . . . . . . . . . . . . . .

THIS RETURN MUST BE FILED ON

15, 2017

6

6. Interest add .50% per month. . . . . . . . . . . . . . . . . . . . . . . . . . .

OR BEFORE FEBRUARY

7

7. Penalty add 50% per month. . . . . . . . . . . . . . . . . . . . . . . . . . .

MAKE CHECK OR MONEY ORDER TO:

8

8. Total (Include Interest and Penalty if Due). . . . . . . . . . . . . . . . .

CITY OF MONROE

INCOME TAX

Name

PO BOX 629

MONROE OH 45050

And

Voice 513-539-7374

Fax 513-539-6209

Address

Period Ending JANUARY

TAX ID

NOTIFY INCOME TAX DEPARTMENT PROMPTLY OF ANY CHANGE IN OWNERSHIP OR NAME AND ADDRESS.

INSTRUCTIONS:

Employers have a legal duty to withhold and remit city tax to the municipalities in which their employees work. Employees may also have

a liability to the municipality in which they reside. Form OW-1 provides for reporting and remitting the tax due to the city of employment

and, if applicable, any additional tax due to the employee's city of residence.

Effective January 1, 2016, employers must withhold and remit payroll withholding tax on qualifying wages as defined in Monroe

Municipal Income Tax Ordinance 2015-40 Section 887.03(34) or Ohio Revised Code Section 718.01(R), unless specifically exempted

under Ordinance Sections 887.051 and 887.052.

TAX RATE: The City of Monroe’s income tax rate is 1.5%.

WITHHOLDING REMITTANCE FREQUENCY: Monthly remittance is required if your prior calendar year withholding exceeded

$2,399.00 or any month of the current year's preceding quarter exceeds $200. All others may remit quarterly.

WITHHOLDING REMITTANCE DUE DATE: Due dates are as stated above. Remittances postmarked by the respective due dates will

be considered timely filed and paid.

LATE FILING PENALTY: The late filing penalty charge is $25.00 per month up to a maximum of $150.00.

UNDERPAYMENT PENALTY: The underpayment penalty charge for late payment of the tax is 50% of the unpaid tax.

INTEREST: All taxes due to the City remaining unpaid after they become due are subject to interest at the rate of 0.50% per month.

Penalty and interest apply to any unpaid employee withholdings and is not eligible for abatement.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7