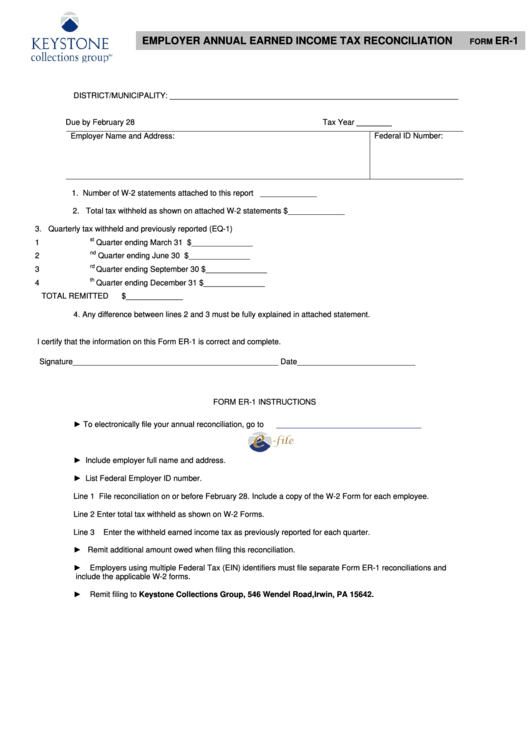

EMPLOYER ANNUAL EARNED INCOME TAX RECONCILIATION

ER-1

FORM

DISTRICT/MUNICIPALITY: __________________________________________________________________

Due by February 28

Tax Year ________

Employer Name and Address:

Federal ID Number:

1. Number of W-2 statements attached to this report

_____________

2. Total tax withheld as shown on attached W-2 statements

$_____________

3. Quarterly tax withheld and previously reported (EQ-1)

st

1

Quarter ending March 31

$______________

nd

2

Quarter ending June 30

$______________

rd

3

Quarter ending September 30

$______________

th

4

Quarter ending December 31

$______________

TOTAL REMITTED

$_____________

4. Any difference between lines 2 and 3 must be fully explained in attached statement.

I certify that the information on this Form ER-1 is correct and complete.

Signature_______________________________________________ Date___________________________

FORM ER-1 INSTRUCTIONS

►

To electronically file your annual reconciliation, go to

►

Include employer full name and address.

►

List Federal Employer ID number.

Line 1

File reconciliation on or before February 28. Include a copy of the W-2 Form for each employee.

Line 2

Enter total tax withheld as shown on W-2 Forms.

Line 3

Enter the withheld earned income tax as previously reported for each quarter.

►

Remit additional amount owed when filing this reconciliation.

►

Employers using multiple Federal Tax (EIN) identifiers must file separate Form ER-1 reconciliations and

include the applicable W-2 forms.

►

Remit filing to Keystone Collections Group, 546 Wendel Road, Irwin, PA 15642.

1

1